2023 Funding Environment for Medical Device Startups

Medical device startups are an essential industry in the US and worldwide. From improving patient outcomes to high-value job creation, these startups are responsible for driving innovation and advancing healthcare.

It’s no secret that we are facing a period of economic uncertainty. Some sources predict the US will enter a recession as the Fed prioritizes lowering inflation after years of quantitative easing.

Challenging economic times affect all lending sectors, including funding for medical devices. Let’s take a closer look.

Overview of the Medical Device Funding Environment

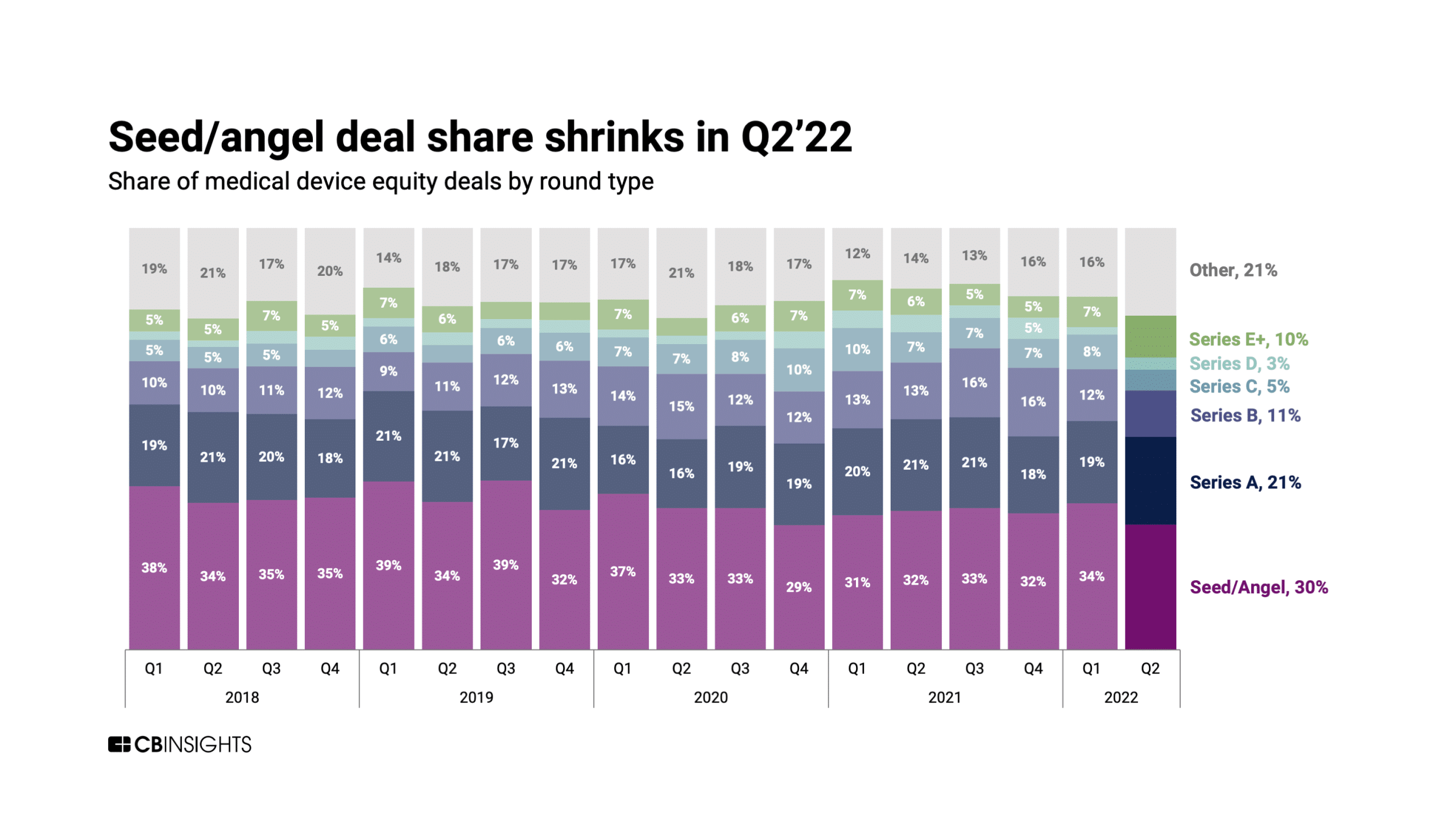

2022 showed a slowing in funding from the 2020 pandemic-fueled boom. While up-to-date data for Q1 2023 is still coming in, funding sources will likely continue their 2022 belt-tightening, making the rest of this year challenging for startups to raise funding. Share on X

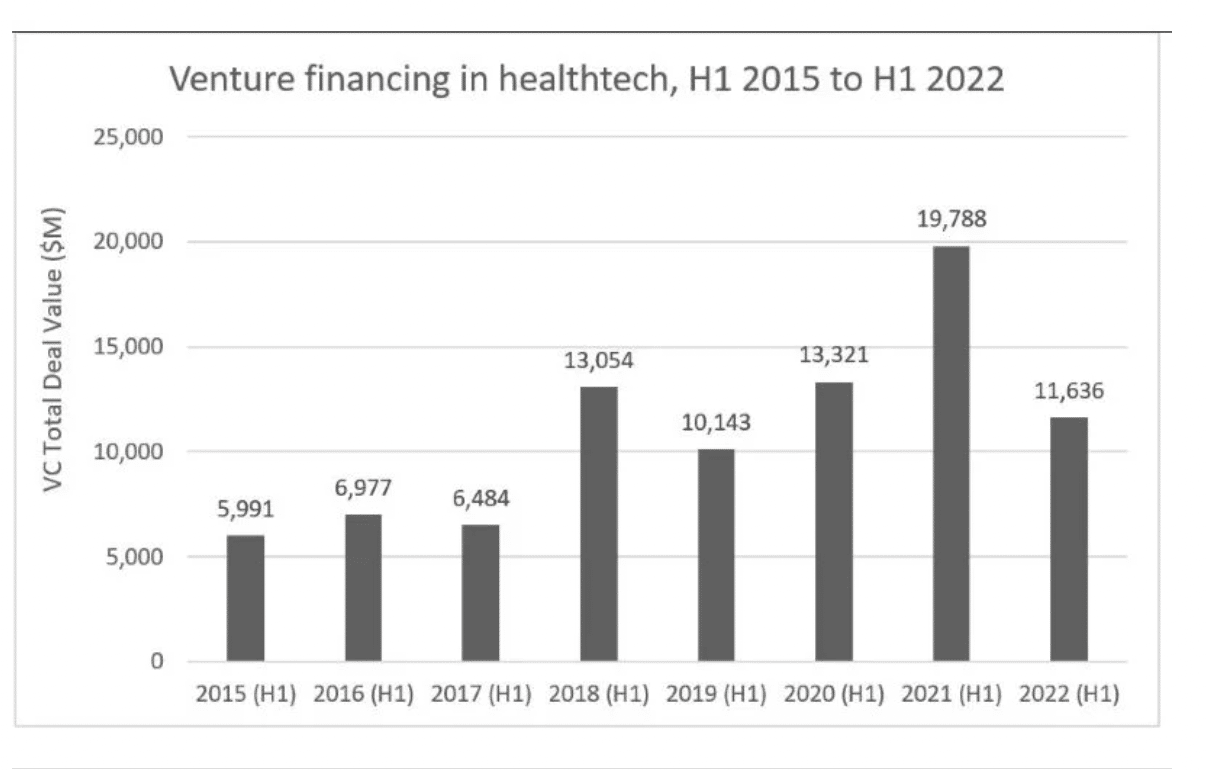

Even previous hot spots like artificial intelligence (AI) deals declined in early 2022. The chart below from Medical Device Network shows funding fell off dramatically from H1 2021 to H1 2022, a reported 41% overall drop in health tech VC funding.

Nevertheless, the healthcare industry, in general, is more recession-proof than other industries. Investors don’t completely sit on the sidelines during slow economic times. North America is still the largest funding market, with almost 70% of all VC deals in health tech.

Traditional Funding Sources for Medical Device Startups

Venture Capital

Venture capital (VC) is crucial in funding medical device startups, providing financing and support to startups in exchange for an ownership stake. In addition to funding, VCs often offer guidance and expertise to help startups navigate the medical device industry’s complex regulatory and commercial landscape. Their involvement can attract other investors and increase a startup’s credibility and visibility.

The top five medical devices deals of Q3 2022 according to Medical Device Network were:

1) Delfi Diagnostics – $225 M

2) Cleerly – $223 M

3) Orchestra BioMed – $110 M

4) JenaValve Technology – $100 M

5) Galvanize Therapeutics – $100 M

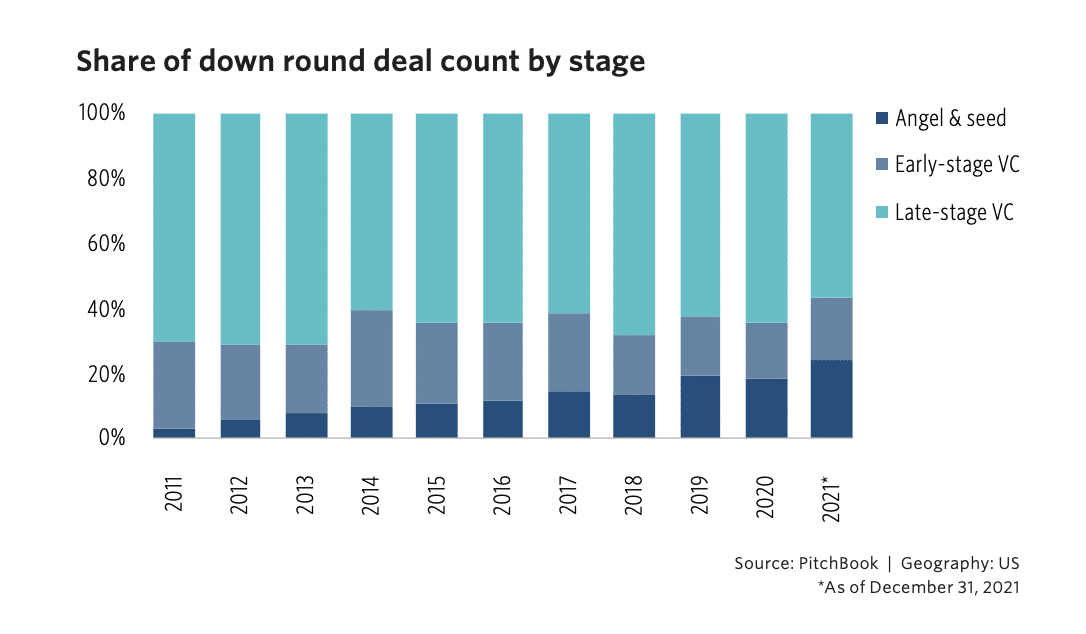

Down rounds

A down round in venture capital funding occurs when a company raises funds at a lower valuation than its previous funding round, which can decrease the company’s value.

In a more challenging economic climate, founders needing additional capital may be looking at down rounds in 2023. Check out Down Rounds, Impacts, and Exit Opportunities, from Pitchbook for a deep dive into down rounds and their potential impact.

Corporate venture capital

Corporate venture capital (CVC) involves corporate investment in external startups or early-stage companies related to the corporation’s business interests. In the case of medical devices, CVCs from healthcare companies invest in medical device startups that complement or expand the product offerings of the corporation, such as life sciences or pharma.

CVC differs from traditional VC in a few ways. First, the corporation typically invests rather than a dedicated venture capital firm. The corporation has a strategic interest in the startup’s success and can provide additional support beyond just funding, such as expertise, access to resources, and potential partnerships.

Second, CVC often has a longer investment horizon than traditional VC. While VCs may be focused on achieving a quick return on investment (ROI) within a few years, CVCs may be more patient and willing to invest in longer-term projects that have the potential to yield significant benefits over a longer period.

Finally, CVC often involves closer collaboration between the corporation and the startup than VC. This can include sharing knowledge and resources, providing access to corporate networks and infrastructure, and even potential acquisitions or partnerships in the future.

HealthTech 50’s 2022 report names Google Ventures as the top CVC in 2022. Of the top 10 investors, 3 were CVCs – Google Ventures, Optum Ventures, and Softbank.

Angel Investors

Angel investors are typically high-net-worth individuals who invest in early-stage startups, including medical device startups. They often invest smaller amounts than VCs and focus on supporting innovative ideas in sectors they enjoy supporting.

Angel investors can provide valuable mentorship, networking opportunities, and access to industry expertise. They may also be more flexible than VCs in terms of the terms of their investment, allowing the startup to retain more control over their business.

The key for startups seeking angel funding is to start early and build relationships, especially in tougher economic times. The image below is an example from SIGNAL’s helpful resource that lists the top medical device seed investors by sector and preferred investment amount. This can be a valuable resource for startup founders to build a networking and content strategy.

Government Grants

Government grants can be important for early-stage medical device startups, as they provide non-dilutive capital that doesn’t require the startup to give up equity. Grants can help the startup achieve essential milestones, such as proof-of-concept studies or regulatory clearance, increasing the company’s value and attracting additional investors.

Government grants also often come with other benefits invaluable to the startup’s success, such as access to research facilities or regulatory assistance. Applications for government grants can be highly competitive. Startups must have a clear research plan and path to commercialization.

Countries have different programs, and sourcing grant opportunities requires some research time. Consider hiring an intern to uncover opportunities specific to your medical device technology. Here are some links to get you started:

United States:

- National Science Foundation Seed Fund (note: these grants are not available for the clinical trials phase)

- HealthIT.gov – Funding announcement updates

- National Institute of Health: Grant Programs and Mechanisms Early Stage

United Kingdom:

- Innovate UK supports business-led innovation in all sectors, technologies, and UK regions.

- NIH Estimates of Funding for Various Research, Condition, and Disease Categories (RCDC)

Australia -New South Wales

India:

This resource from Invest India has some updated links for 2023.

Alternative Funding Opportunities for Medical Device Startups

Equity crowdfunding

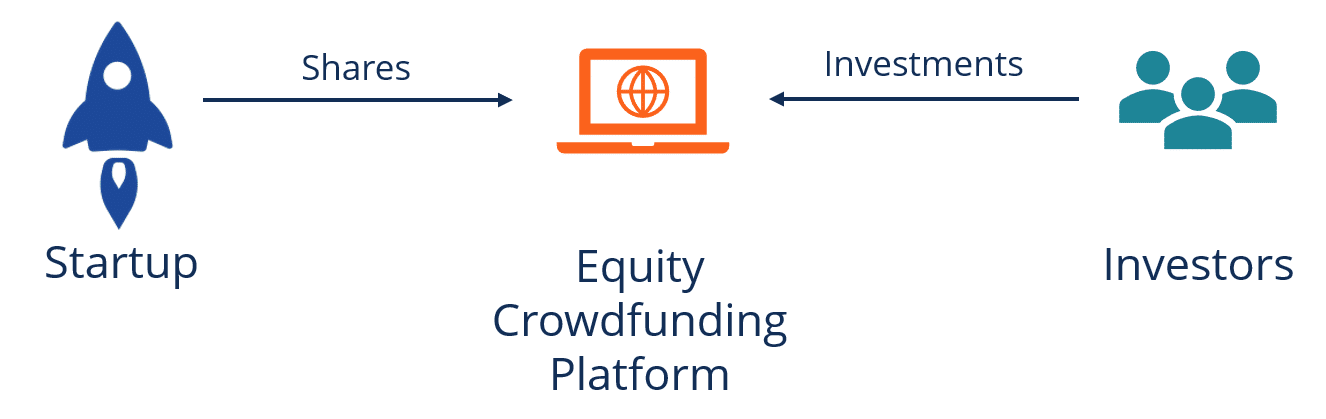

Crowdfunding is a way of raising money from a wider audience, leveraging the internet. In medical device funding, crowdfunding involves using online platforms to solicit investments from individuals to finance the development and production of a medical device.

It’s important to know that not all crowdfunding models are the same in the eyes of the SEC and FDA. Medical device startups cannot run a fundraising campaign on Indiegogo to the general public, for example. That is because soliciting for investment in a business qualifies as selling securities, an activity that falls under SEC scrutiny and regulation.

Equity Crowdfunding is the type of crowdfunding that applies to medical device companies. Campaigns are required to use regulated platforms, and investors must be pre-qualified. Campaigns must also be careful not to violate FDA rules prohibiting pre-selling.

Equity crowdfunding sites with medical device experience include Angel list, Crowdcube, and Republic.io. You can also check out Fortune Builder’s resource list for the top 15 equity crowdfunding platforms from 2022.

Accelerators and incubators

Startup accelerators and incubators are a vital part of the funding ecosystem because they offer operational support and expertise that can increase the odds of a startup’s success. Accelerators can also be a great way for startups to, in a sense, “buy time” during tough economic times to continue to make progress and form connections.

Accelerator programs “accelerate” startups’ growth by providing mentorship, connections, and seed funding. Some accelerators may offer seed funding in exchange for a small equity stake. Participating teams must relocate if they are not local, and accelerator programs have fixed start and end dates.

Incubators offer more flexibility as the length of participation is open-ended, making incubators an ideal option for founders who need time to refine their business plan and product-market fit.

Like accelerators, incubators provide networking opportunities, mentorship, and access to resources for building a business. Incubators are usually located in shared co-working spaces to promote collaboration and exchange ideas.

Check out our blog post Spotlight on Medical Device Incubators and Accelerators for a deeper dive.

Special Purpose Acquisition Companies (SPAC)

SPACs are a fundraising tool to raise money through an initial public offering (IPO) to buy another company. Another name for a SPAC is a “blank check company” because the SPAC doesn’t have the trappings of a traditional company.

SPACs have two years to complete an acquisition, or they must return their funds to investors. We covered SPACs in our 2022 Update: Funding Landscape for Medical Device Startups. In the last few months, the sector has been drying up due to a variety of factors.

Moving Ahead

Fundraising in this industry can span several years and multiple rounds. Companies need the right technology, a viable business strategy, and a fundraising strategy to bring medical devices to market successfully.

At Galen Data, we have walked alongside many of our clients during their fundraising journey. If you have any questions about how to attract investors or any other questions related to bringing your device from idea to market, feel free to contact us.