3 Top Trends in Direct to Consumer Market for Medical Devices

You don’t have to be a grandparent to remember when the entirety of your medical history was in a fat color-coded file at the doctor’s office or hospital medical records department. Due to institutional resistance and privacy considerations, it wasn’t until the late 1990s that health care providers began to digitize medical records.

With the rise of medical sensors and wearable tech, the days of the hard-copy patient chart as the sole source of your medical history are long gone. Smart devices, wireless and internet connectivity are enabling anyone to begin amassing health-related data. Consumer demand from people wanting to monitor their own health indicators is causing a revolution blurring the marketplace between medical devices and wellness trackers.

We are seeing a dramatic rise in the direct-to-consumer market for medical devices. End users fall into two categories that can overlap – patients, who in traditional medicine don’t have a say in choosing the medical device, and general consumers tracking their data for wellness.

Blurring the Lines Between B2C and B2B for Medical Devices

Part of the regulatory confusion for consumers, patients, and new entrants into the medical device field is that a gadget’s form factor may seem to fit the definition of a “device.” However, FDA approval isn’t based on the object itself. The FDA isn’t interested in a smartwatch or bracelet that simply tracks steps or logs calories.

If that smartwatch has an app with a potential diagnostic function, such as an electrocardiogram (ECG) app, that is a different story. Same gadget, very different potential implications from the data.

The consumer medical device market landscape is changing at a time when demand is skyrocketing. Share on XSome of the trends driving demand include:

- Unfortunately, lifestyle-associated diseases, such as hypertension and diabetes, are projected to increase over the next decade. These conditions, and others as well, require routine monitoring. However, it will be interesting to see if widespread adoption of wearables will have beneficial preventive effects that impact the projected increase.

- Patients demand greater personalization in care for other chronic non-communicable diseases like cancer. Wearables provide a continuous stream of personalized data that can help health care providers tweak treatments and personalize results.

- Covid-19 sparked a greater interest in a healthy lifestyle among many people interested in tracking their vital signs as a part of their wellness journey.

- Increasing penetration of 5G technology globally will increase the pipeline for collecting and aggregating data from devices.

- Healthcare Delivery Organizations (HDOs) will drive demand as they see the cost savings benefits of telehealth and at-home monitoring.

Companies like Apple and Samsung, with huge non-patient B2C market share, are entering the medical device space. Many others are joining them. This post will look at 3 top trends in the direct-to-consumer market for medical devices.

Wearable Device Technology

Interest in wearable technology, like smartwatches, jewelry, and clothing, is growing as more people realize that technology can give them a window into what their body is doing. In addition, health care providers are capitalizing on the opportunity to monitor a patient’s condition before and after treatment in hospitals, outpatient centers, or the doctor’s office.

North America has the highest share in the global device market, at 36.1% in 2091, driven by burgeoning demand in the US. The US market for wearable medical devices in 2018 was US$ 24,571.8 Mn and is forecast to grow to US$ 139,353.6 Mn by 2026.

Apple’s smartwatch and the now-ubiquitous FitBit are what many people think of as wearables. As the industry grows, we see more consumer product companies and traditional medical device companies entering the B2C wearable space. Some of the companies operating the industry are:

- Huawei

- Garmin

- Samsung

- BD

- Ypsomed AG

- Sonova

- Hologic Inc.

- AiQ Smart Clothing

- NeuroMetrix, Inc.

- Siemens Healthcare GmbH

- SAMSUNG

Consumer market wearables and the FDA.

As demand increased since 2018 for regulatory approvals, the FDA worked with consumer wearables pioneers like Apple and Fitbit to streamline the approval hurdles. Simplifying the regulatory process is key to growth, and Fortune Business Insights predicts that increasing approvals will help drive global growth for the wearable medical devices market in the future.

Non-fashion statement wearables without flashy ads are often included in Remote Patient Monitoring (RPM) devices that HDOs are including with outpatient care. An RPM can be a bundle of devices used to monitor patient health at home or work. RPM devices are also showing up in consumer outlets like drug stores and online shopping marketplaces.

Health Monitoring in the Home

Home health monitoring can include both wearable technology and other devices. Data collected at home that is actively reviewed by a health care professional is generally is in the context of a patient who has or is recovering from a medical procedure or chronic condition, in contrast to someone who is tracking their vitals for general wellness.

For this reason, the FDA is active in the home use medical devices space, defining a home medical device as follows:

A home use medical device is a medical device intended for users in any environment outside of a professional healthcare facility. This includes devices intended for use in both professional healthcare facilities and homes.

- A user is a patient (care recipient), caregiver, or family member that directly uses the device or provides assistance in using the device.

- A qualified healthcare professional is a licensed or non-licensed healthcare professional with proficient skill and experience with the use of the device so that they can aid or train care recipients and caregivers to use and maintain the device.

The Mayo Clinic tested an interesting pilot of home health monitoring in action during the COVID-19 crisis. They developed two tracks for COVID-19 patients. On track was for patients at moderate to high risk for complications and one for lower-risk patients. High-risk patients received a remote monitoring kit with a blood pressure cuff, thermometer, pulse oximeter, and a weight scale. They were instructed to use these devices two to four times a day to measure their vital signs. This data was sent automatically to Mayo Clinic through a smart mobile device (tablet) that patients receive with their kits.

Remote Patient Monitoring doesn’t mean patient monitoring is 100% on cruise control, though. Nurses called the higher-risk patients to flag symptoms such as nausea and shortness of breath.

Lower risk patients recorded their vital signs using the Mayo Clinic app. They received daily reminders and instructions to send their information to the care team.

Among other benefits, this program allowed the care team to respond as early as possible to significant changes in vitals. It also provided critical psychological support to patients in quarantine.

This speaks to a related health care industry trend of a shift to value-based, patient-centric care is seen as a positive for patients. At home, monitoring helps them feel like they are not out of sight, out of mind. They receive regular feedback from their health care team, both automated and personalized. This reduces stress levels, which can have a positive effect on recovery.

At-home monitoring kits can vary widely and be personalized for different conditions. Some examples include:

- TytoHome: A remote health examination kit by TytoCare. Includes digital camera, thermometer, tongue depressor, an otoscope, and a stethoscope.

- ADAMM: A smart healthcare monitoring system for asthma

- LARQ: An automatic water purifying water bottle to purify water from rivers or sources. Use cases include disaster recovery and travel medicine.

- Ara: A line of smart toothbrushes by Kolibree

- iHealth Smart Wireless Glucose Monitoring System by iHealth Labs

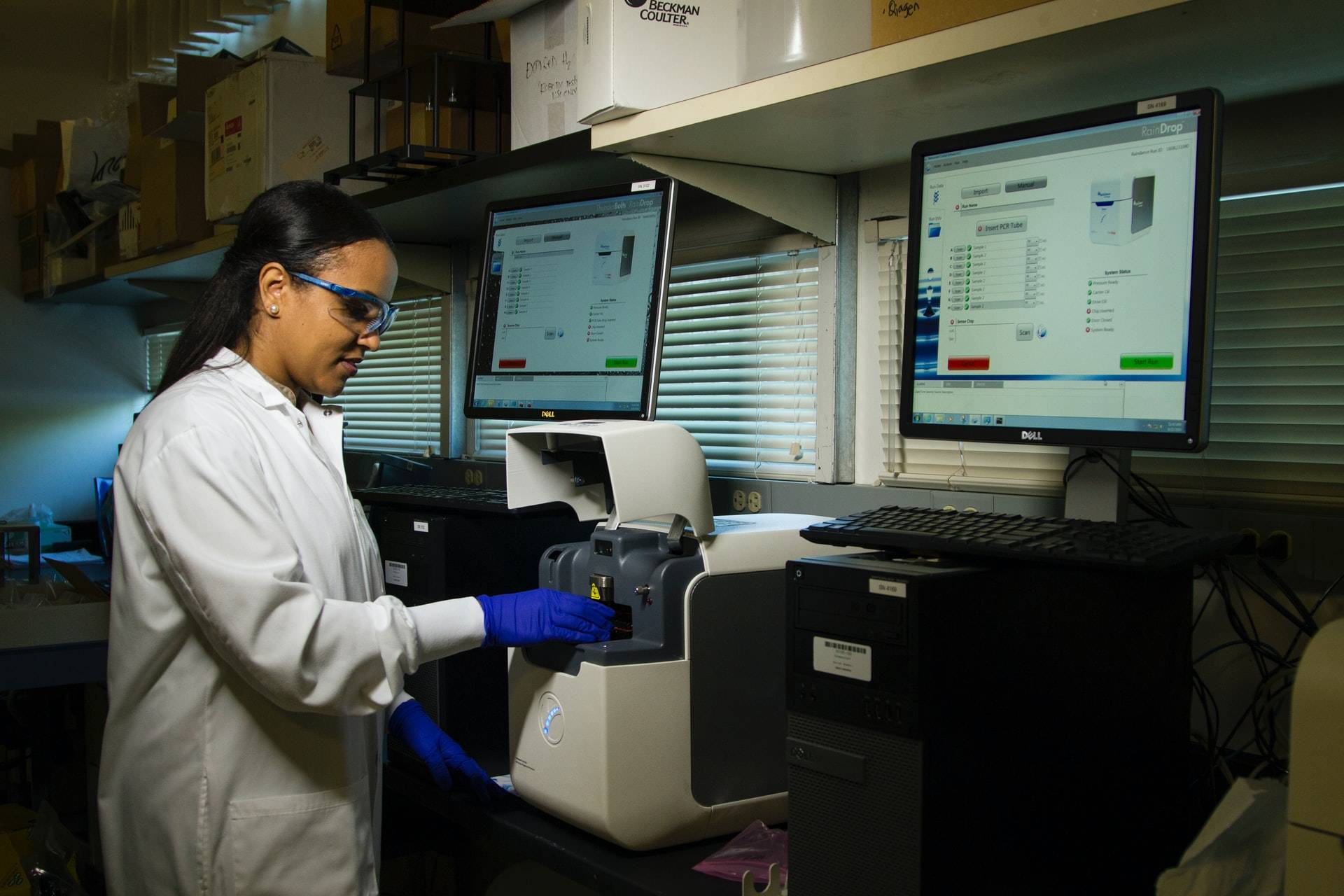

Home to Lab: Home Diagnostic Tests

Patients and consumers not only want to monitor their existing conditions, but they want to be able to diagnose or at least pre-diagnose certain conditions without having to go to the doctor’s office. Pregnancy tests were an early version of this, of course.

Now, As the world opens up and adjusts to a post-COVID-19 world, the variants continue to drive demand for at-home testing. COVID screening tests are a large sector of a burgeoning marketplace for the test-at-home health market. According to Quest Diagnostics, the market for consumer-driven health testing may be worth more than $2 billion by 2025.

Other examples of at-home testing that represent huge markets niches in the medical, health, and wellness industries include:

- Disease Screening (including STDs)

- Genetic Testing

- Hormone Imbalance

- Food Sensitivity & Nutrition

- Heavy Metals Testing

Home diagnostic tests are under more scrutiny from the public and regulatory officials due to the aftermath of the Theranos controversy. Critical considerations for competitive advantage include focusing not just on the utility of the device and test, but on the customer journey itself. For example, ease of use, telehealth support after the test, and claims backed by research and FDA approval are differentiating factors from the consumer’s point of view.

Bias and Complexity in Consumer Market for Medical Devices

A connected medical device’s basic function is to relay data to be aggregated, analyzed, and acted upon. Patient outcomes and the popularity of the device will obviously be influenced by the quality of the data.

As more patients participate in collecting and reporting data, two major factors arise:

- Accuracy of reporting. MDMs can improve accuracy with ease of use and high-quality patient ‘How To” instructions.

- Awareness of bias in AI. Health care providers reviewing data from medical devices may rely on AAI-influenced suggestions as to the next steps for patient care. The industry is aware of examples of AI bias due to biased data. The good news is, Medical Device Manufacturers can get ahead of potential controversies by raising questions in the development process about the potential for built-in AI bias.

For medical device manufacturers considering entering a broader consumer market, the first step is to remember that from the consumer’s perspective, a gadget is a gadget. The second step is realizing that the regulatory implications may take a very different view. At Galen, our team can help you navigate the complexities. Contact us today to get the conversation started.