Five Key Artificial Intelligence (AI) Trends for Medical Device Companies in 2022

One challenge for medical device companies in 2022 is the proliferation of competition fueled by user demand and a favorable funding climate for startups.

In this post, we help sharpen your edge by reviewing five Artificial Intelligence (AI) trends affecting the health care industry, providers, workers, investors, and last but not least, patients. The MedTech industry evolves quickly. Medical device companies need to keep up with stakeholder expectations to remain competitive.

Starting at the 10,000-foot level, the McKinsey Global Institute identifies twelve trends that will reshape overall business by 2025. Eight of them directly impact the health care industry:

- Artificial intelligence

- Virtual and augmented reality

- Cloud technology

- Internet of things

- Advanced robotics

- Biometric technology

- Genomics

- Blockchain

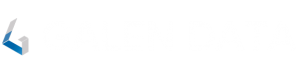

As you can see, AI tops the list. The market potential is significant. Grand View Research projects the AI healthcare market to increase from $3.6 billion in 2020 to $120.2 Billion in 2028.

Perhaps more than any industry, healthcare mirrors the challenges and promise of AI. Increasing amounts of data from smart devices are driving demand for quality AI to make the data useful. To use an adage making the rounds on the web, data is like crude oil – not very useful until it is refined into usable fuel.

Secondly, data is not monolithic. In health care, data contains sensitive information about real people with privacy concerns. Jane Doe is understandably more sensitive about access to her diabetes diagnosis data than what Amazon knows about her toothpaste preferences. Government agencies are updating rules in an already heavily regulated space, including tackling cyber security regulation challenges.

In some respects, AI is the meta-trend for 2022 because data and demand for useful outcomes from that data are both increasing exponentially. Check out five trends to keep an eye on in the coming year.

MedTech and Medical Device Industry Trends for 2022

Five significant trends are brewing in the competitive landscape for MedTech and medical device companies:

- Internet of Things (IoT) and wearable devices.

- Personalization of diagnosis and treatment for hyper-segmented patient populations.

- Regulatory framework and its effect on funding and innovation.

- The harsh reality of the shortage of healthcare workers, with no end in sight.

A fifth trend is an uptick in investment in Medtech from companies outside of the healthcare industry. This trend shows up in relation to trends one and two, so you’ll see it mentioned in Let’s start with looking at life beyond the Fitbit.

Internet of Things (IoT) and Wearable Devices

Wearable devices are a huge sector in the IoT, being the universe of smart devices that monitor and send data about real-world environments to the Cloud.

Wearables are interesting because some break down traditional boundaries between health care, fashion, and consumer psychology. The traditional healthcare industry did not consider the patient a customer in the retail sense.

Lines are now blurring as some devices become a fashion statement. Smart clothing and smartwatches are common examples. FitBits were a status symbol when they first hit the market and smart jewelry is following suit.

The bottom line is if the device is visible, the customer or patient has a different emotional response to it than if the device is hidden. This is because the things we wear say something about our identity. Having empathy for that mindset can be an opportunity for medical device designers.

Making devices more appealing to consumers is one reason why we see non-healthcare B2C companies continue to enter the wearables market; such as clothing brands like Under Armour, Tommy Hilfiger, Levi’s, and Ralph Lauren.

Coordination and integration of Medical Devices

As devices proliferate, users and health care providers want them to be seen to play nice with each other. Devices that coordinate and bundle technology to produce valuable insights seamlessly will stand out as more desirable to consumers.

Related to that, many healthcare providers are looking beyond single medical devices as a standalone offering. One source says healthcare companies are looking for a portfolio of coordinated devices backed by robust AI to “act as a solution to a disease state challenge.”

Personalization, Prediction, and Hyper-Segmentation of Consumers

As providers collect more extensive data sets, diagnoses become more personalized and predictive. Benefits include early detection, which leads to better health outcomes for the patient and cost savings for everyone.

Personalization depends on data, AI’s time to learn (experience), and applied technology. For over a decade, non-healthcare companies like Amazon have developed data platforms and used machine learning to improve personalization for customers.

Within the boundaries of privacy regulations, we can expect to see similar improvements in customer data platforms for healthcare companies, aided by expertise from crossover non-healthcare companies such as Adobe and Saleaforce.

One welcome sub-trend related to personalization is the hyper-segmentation of patients in traditionally underserved cohorts. Devices now gather data from patients not represented in legacy studies, such as minorities, LGBTQ, women, and other traditionally underserved communities. AI enables providers to develop personalized treatment plans customized for indicators unique to those communities.

Regulatory Landscape Impacting Investment

As the FDA adapts regulations to AI and other new technologies, its actions may affect the funding climate for startups and innovation research. Additionally, the FDA isn’t the only regulatory force that affects investors’ mindsets.

Federal and state lawmakers are demanding more pricing transparency from bio-Pharma companies. President Biden’s plan limits some price increases and allows Medicare to negotiate directly with drug manufacturers. New price transparency requirements for hospitals and health plans will take effect in 2022.

State governments are also considering new legislation to regulate drug prices. While providing relief to patients struggling with high drug costs, all the regulatory rumblings are a red flag to the investment community which could impact the funding of new research and companies for MedTech AI.

Better Care with Fewer People – Healthcare Worker Shortage

As part of the COVID-19 pandemic fallout, nearly 20% of healthcare workers quit their job. This loss creates both stress and opportunity. Lack of staffing stresses the system because the shortages are immediate and chronic. The opportunity exists because as AI algorithms get more intelligent, they can reliably do more of the tasks that clinicians now must do or at least oversee. You could even say that the whole point of AI in healthcare is “better care with fewer people.”

Examples of tasks AI is taking over include reading image scans and virtual healthcare assistants. In a short-staffed workplace, ease of use is paramount. Devices and technologies that simplify and streamline the worker experience may have a significant advantage. Medical device companies may work to improve their AI and make their devices even smarter. Prioritizing UX and human-centered design may also increase competitive advantage.

Home healthcare is another area where non-healthcare companies are entering the fray. Monitoring medical devices are integrating Amazon’s Alexa into hospital rooms, and Amazon itself is piloting Alexa Together, a subscription service to help families with elderly patient homecare.

Best Buy also recently acquired Current Health, an at-home tech care startup. If you wonder what printer cartridges, laptops, and the Geek Squad have to do with home health care, you aren’t alone.

Deborah Di Sanzo, President of Best Buy Health, describes a different future in an interview with Forbes:

“The future of consumer technology is directly connected to the future of healthcare… [we] have the distinct expertise in helping customers make technology work for them directly in their homes and by combining Current Health’s remote care management platform with our existing health products and services, we can create a holistic care ecosystem that shows up for someone across all of their healthcare needs.”

Best Buy’s vision is an excellent example of the end-to-end functionality providers and consumers are looking for, similar to the “portfolio” concept mentioned above in the Wearables trend section.

Making the Most of 2022 with an AI Trend Strategy

Which trend do you see as most important for your business this year? Creating a strategy to adapt and exploit this year’s trends doesn’t need to be complex.

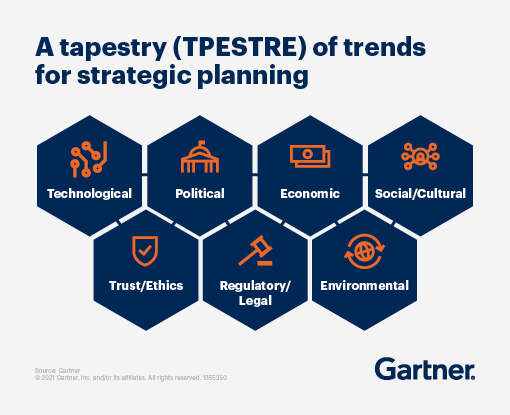

Sometimes the simplest approach is best. Gartner and other strategy companies provide simplified templates that may be helpful to get you started. And of course, if you have any questions about the compliance and data landscape for 2022, feel free to contact us, we are here for you.