Five Top Funding Sources for Medical Device Startups

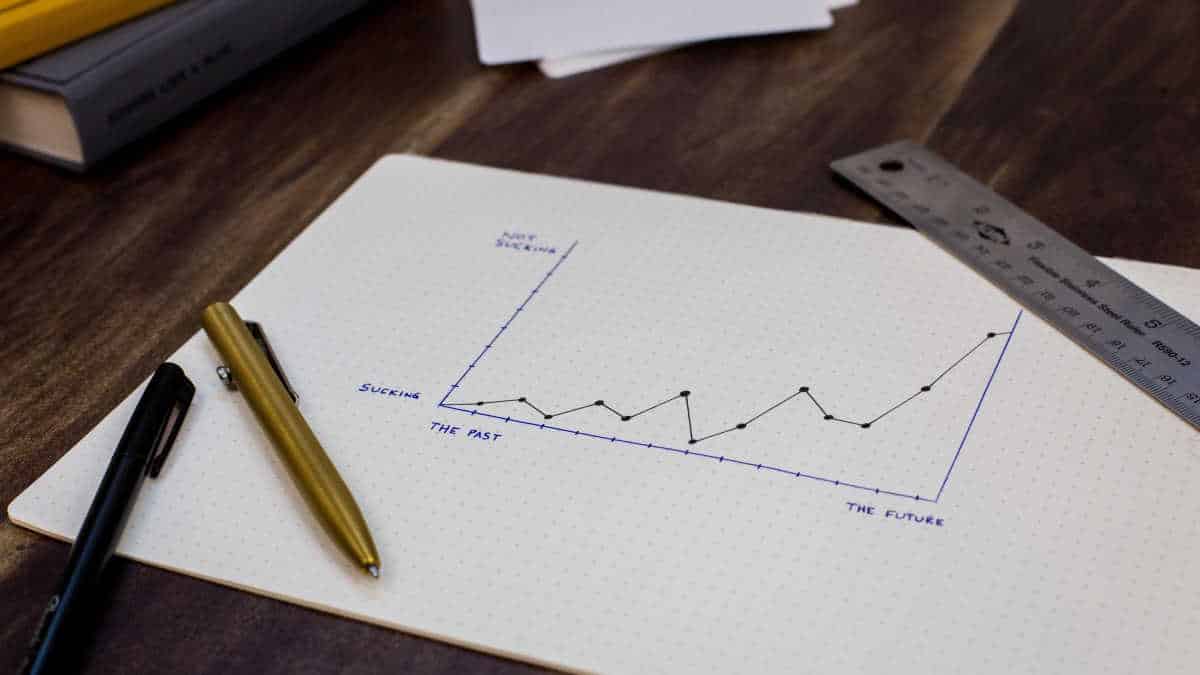

Taking a medical device company from an innovative idea to a strong market position is a unique process in the startup world. The lengthy regulatory approval process and high upfront costs associated with clinical trials create a specialized funding landscape. The guaranteed time lag between funding and revenue is one reason investment capital is indispensable in medical device innovation.

While it can seem daunting at first, you can navigate funding hurdles and turn your vision into reality with the right approach and strategic partnerships. Funding strategy should be part of the planning from day one. That is why understanding the five top funding sources for medical device startups is so valuable.

Let’s take a look.

What Are the Stages of Advanced Medical Device Funding?

Before discussing the specifics of different funding sources, let’s briefly understand the various funding stages typically encountered by startups.

Advanced Medical Device Development Funding Stages

The funding journey for medical device companies is typically categorized into stages, each with its funding requirements and milestones. Here is a brief overview:

Seed Funding: This early-stage funding provides capital to develop a prototype, conduct initial feasibility studies, and validate your concept.

Experienced consultants for medical device investment point out that the early stage is the most difficult phase to secure funding. Some say it is easier to raise $15 M later stage money than the first $500,000.

Seed and pre-seed funding rounds are challenging due to the limited capital sources for these high-risk ventures. However, the landscape is evolving. One bright spot is the increasing role of family offices and incubators in providing crucial funding for early-stage medical device startups. Universities and venture studios are also important players in the early funding space.

Series A Funding: Focuses on further development, testing, and pre-clinical trials.

Series B Funding: Funds larger clinical trials and pilot programs to gather safety and efficacy data.

Series C Funding: Secures funding for regulatory approvals and market launch.

A note about exit strategy: It’s important to note that while securing funding is crucial for growth, a successful exit strategy is also vital for many entrepreneurs. Some medical device companies may consider a managed buyout by a private equity firm as an exit option.

Understanding the funding stages will help you determine the most suitable funding source for your needs. In the next section, we’ll explore the top five funding options for startups.

Major Players in Funding for Medical Device Startups

Now that we understand the funding landscape and different stages let’s look at the top five ways startups receive funding:

Venture Capital (VC) Firms

Venture capital is the most common source of funding for medical device startups. VC firms are professional investors who manage pools of capital from wealthy individuals and institutions. They invest in high-risk companies that don’t qualify for conventional business financing. They look for high-growth companies with the potential for significant returns.

Some funds investing in medical devices include Felicis Ventures, New Enterprise Associates (NEA), SV Health Investors, BoxGroup, and Civilization Ventures.

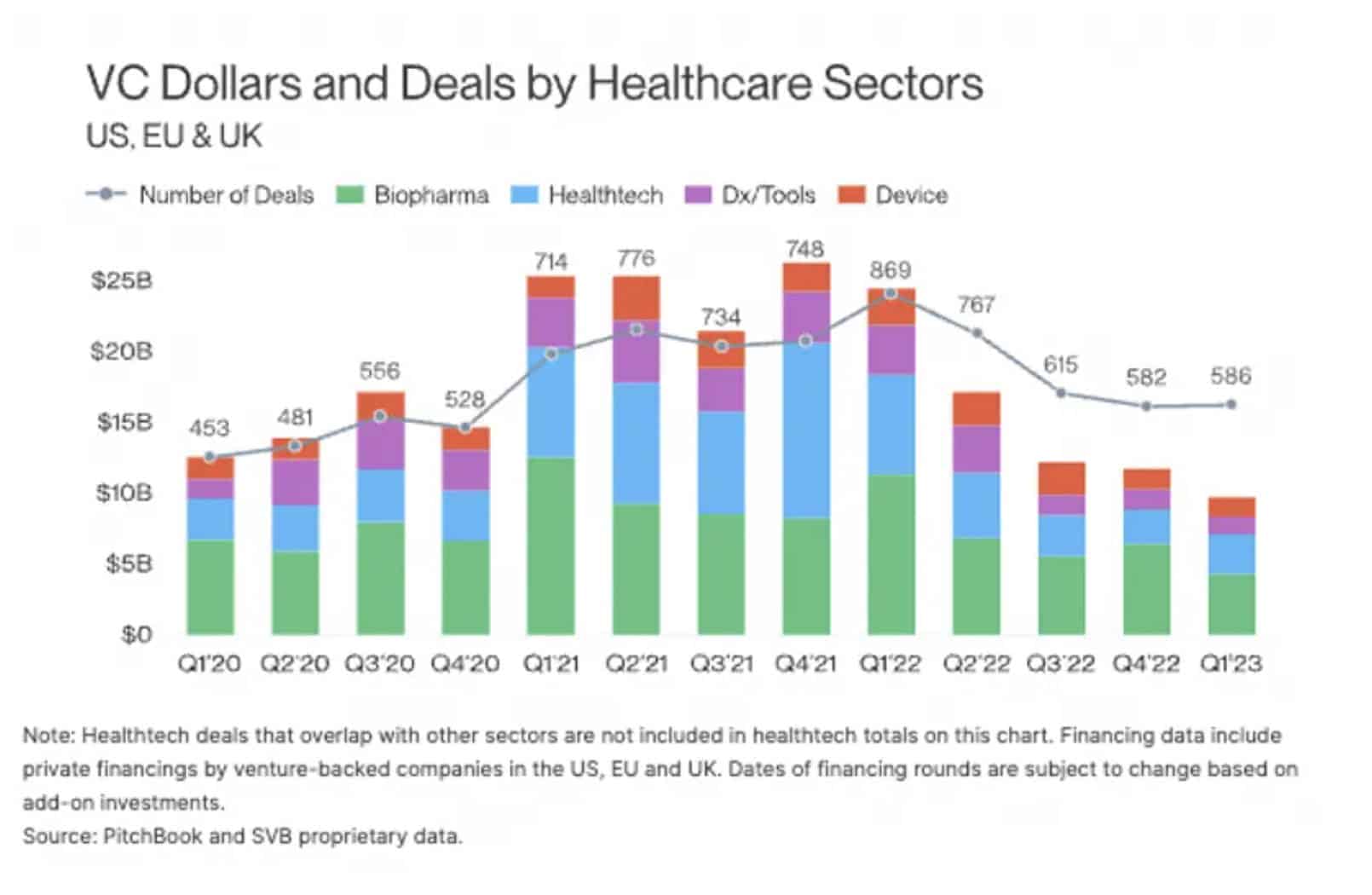

Due to the complexity of the technology and healthcare industry, VCs specializing in medtech startups make up the largest percentage of healthcare investment deals, especially in promising areas like digital health and life sciences.

Unfortunately for medical device entrepreneurs, VC funding has declined significantly since 2022.

Chart from this article: Source: Visible.VC

What to Expect from Venture Partners

Investment Size: Typically invest in Series A and later funding rounds, ranging from millions to tens of millions of dollars.

Focus: VCs look for companies with strong intellectual property, a well-defined regulatory strategy, and a clear path to market.

Benefits: Beyond venture capital, VCs can provide valuable mentorship, industry connections, and strategic guidance.

Angel Investors

Angels are wealthy individuals or family offices who invest their capital in early-stage ventures. They can be a good source of funding for seed-stage startups, often motivated by a passion for the healthcare industry or a belief in the technology’s potential.

What to Expect from Angels:

Investment Size: Typically invest smaller amounts, ranging from tens of thousands to a few million dollars.

Focus: May be more willing to invest in high-risk, early-stage ideas compared to VCs.

Benefits: Offer valuable industry experience, and mentorship, and can help build your network of contacts.

Strategic Investors

Strategic investors have established companies in the medical device space that invest in startups with complementary technologies or that could be potential acquisition targets.

What to Expect from Strategic Investors

Investment size: Varies depending on the strategic fit.

Focus on: These investors look for ideas that enhance their product portfolio, expand into new markets, or accelerate innovation efforts.

Benefits: Offer expertise in the medical device industry, potential co-development opportunities, and access to distribution channels.

Government Grants

Government grant programs like the Small Business Innovation Research (SBIR) program can be a valuable source of non-dilutive funding (meaning you don’t give up equity in your company) for medical device companies.

These grants support early-stage research and development in specific technological areas.

What to Expect from Government Grants

Investment Size: Grants typically range from tens of thousands to a few hundred thousand dollars.

Focus: Programs have specific focus areas, often aligned with national healthcare priorities.

Benefits: Provides non-dilutive funding, allowing you to retain ownership and control of your company.

Equity Crowdfunding Platforms

Equity crowdfunding platforms allow startups to raise capital from a large pool of individual investors.

While websites like IndieGogo and Kickstarter also offer “Crowdfunding”, it’s important to know that medical device startups cannot post their projects on consumer crowdfunding websites due to US securities laws. While not as common for medical devices due to these regulatory restrictions, some platforms exist specifically for healthcare ventures. Equity crowdfunding sites with medical device experience include Angel List, Crowdcube, and Republic.io.

What to Expect from Equity Crowdfunding

Investment Size Can vary greatly depending on the platform and campaign.

Focus: Democratizes access to capital but requires a compelling campaign and effective marketing strategy.

Benefits: Can generate early interest and build a community around your product.

In the next section, we’ll discuss choosing the right funding source for your medical device startup.

Bonus: Funding from Academic Institutions

University Grants or Research Funding: Some large universities have grant programs or research funding initiatives to support early-stage innovation, including medical devices. This funding might come from the university’s endowment or specific donors interested in medical research.

Matching Your Needs with the Right Funding Source

Choosing the right funding source is crucial for the success of your medical device startup. Here’s a table summarizing the key characteristics of each option:

What to Consider When Choosing Between the Five Top Funding Sources for Medical Device Startups

There is no single funding solution for all startups. Medical device use cases vary widely. Different teams have different approaches and expectations. Here are a few things to keep in mind when developing a fundraising strategy:

Funding Stage: Match your funding needs with the typical investment size of each source.

Company Needs: Consider whether you require mentorship, industry connections, or capital.

Regulatory Strategy: Some investors may have expertise or preferences regarding regulatory hurdles.

Equity Dilution: Evaluate how much control you will give up in exchange for funding. If you are just starting, remember that this is an ongoing negotiation – for example, founders moving from seed round to series A may be asked to give up further equity.

Develop a strong business plan: A well-defined plan outlining your technology, market opportunity, and financial projections is essential to attract any investor. Your business plan should be updated regularly to reflect internal learning as well as changing market conditions.

Network with potential investors: Attend industry events, conferences, and pitch competitions to connect with relevant funding sources.

Prepare a compelling pitch deck: A concise and informative presentation summarizing your company and funding request is crucial for securing investment.

Moving Ahead

Remember, a secure and scalable data management plan is essential for startups navigating the complex regulatory landscape. GalenData’s cloud platform can streamline your data collection, storage, and analysis processes, freeing up valuable resources to focus on innovation.

Partner with GalenData today to develop a secure and scalable data management plan. Schedule a call with us today to discuss your specific needs.