Update on Cancer Sector for Medical Device Manufacturers

In 2016, then-Vice President Joe Biden launched the Cancer Moonshot program to accelerate progress in the war on cancer. Now President Biden’s administration is once again bringing cancer to the forefront of national health care priorities.

On February 2, 2022, the White House released a statement re-launching the Cancer Moonshot. The Administration hopes to leverage recent progress in cancer therapeutics, diagnostics, patient-driven care, and lessons learned from COVID-19, to reduce the death rate from cancer by at least 50 percent over the next 25 years. The end goal, of course, is to end cancer overall.

The COVID-19 lockdowns dramatically reduced elective appointments, including the number of cancer screening and diagnostic procedures. For that reason, the Cancer Moonshot includes a call to action for cancer screening to begin to recapture the screenings that were missed during the pandemic.

This renewed government emphasis is good news for patients, medical device startups, and manufacturers working in the cancer sector. Let’s look at the current landscape.

Cancer Statistics and Trends

Since 1990, cancer has been the second most common cause of death in the US, after heart disease. The four most common types of cancer globally account for 43% of all new cases, and they are prostate, lung, bowel, and female breast cancer. Cancers with the largest projected increase include female breast, colon, and prostate.

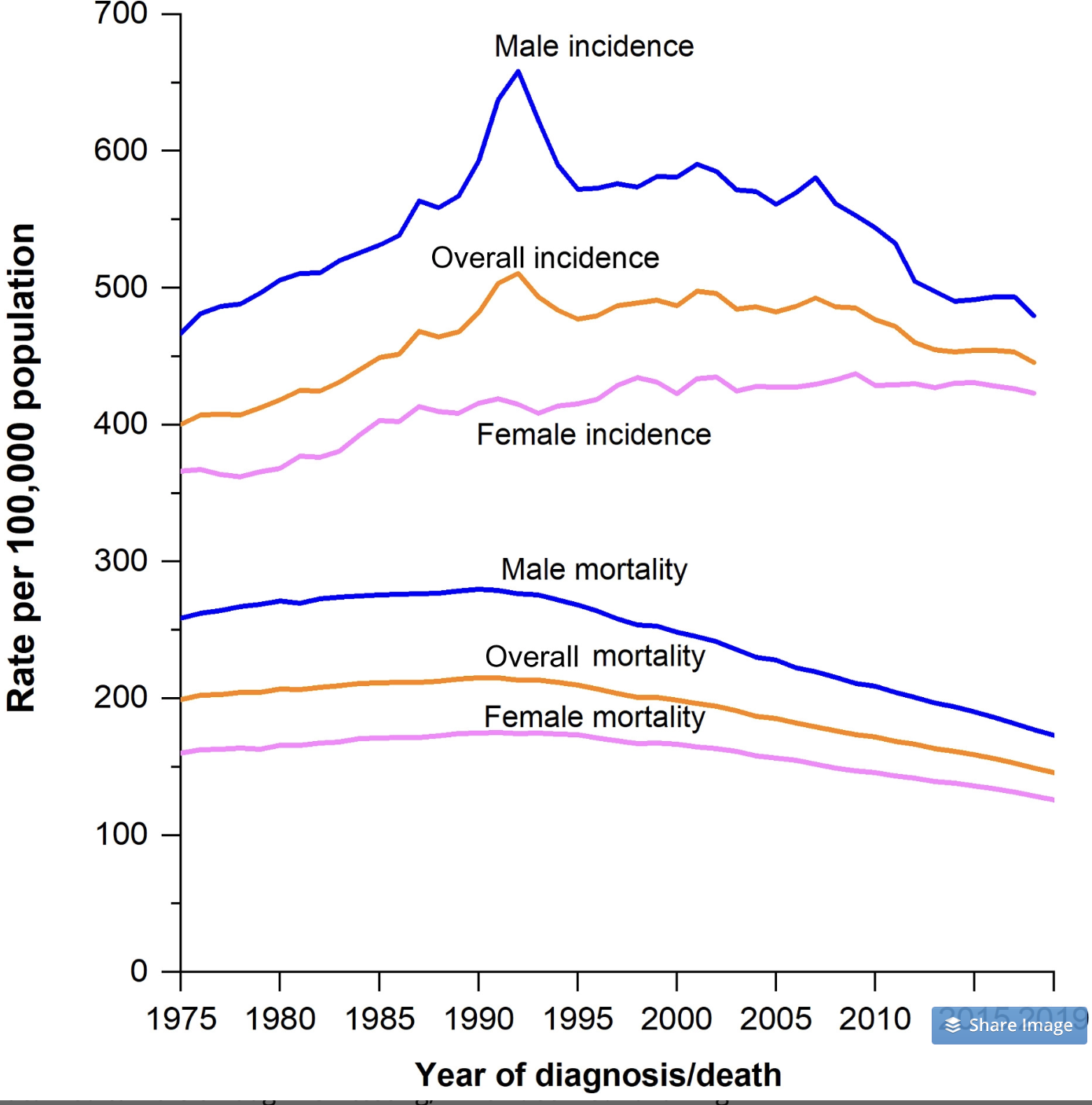

The good news is that fewer people smoking, early detection, and chemo after surgery have all helped decrease the cancer fatality rate between 1991 and 2019 by 32%.

Trends in Cancer Incidence (1975-2018) and Mortality (1975-2019) Rates by Sex, United States. Rates are age-adjusted to the 2000 US standard population. Incidence rates are also adjusted for delays in reporting. source

However, the CDC also predicts that because of growing numbers of older Americans, the annual number of cancer cases will increase by 49% from 2015 to 2050, with the largest percentage increase among adults over 75 years old.

While aging trends are relatively easy to predict and track, innovation tends to be less linear. 2050 is almost three decades away. Think about the innovations we have now that no one had an inkling of 30 years ago. The health care industry and the oncology sector are just beginning to absorb the impact of emerging technologies.

Industry consultants point out that health care is already being transformed by technology and that innovation will accelerate in the future. In fact, innovations on the horizon include computer-aided cancer diagnostics, new biopsy tools for better sample quality, nanoparticles engineered to destroy cancer cells, and prostate cancer focal therapy.

External social trends, policy factors, and new business models also will affect the industry. Deloitte pinpoints six specific overall trends that are also interesting for oncology medical device manufacturers and startups.

- Data Sharing: Research says 46% of consumers are willing to share their medical information with health plans and clinicians. 20% have shared medication data with their doctors.

- Interoperable Data: In March 2020, the US Department of Health and Human Services (HHS) finalized its interoperability rules to begin the process of connecting currently fragmented and siloed health care data into one secure system.

- Equitable Access: Technology and virtual care can overcome some barriers of geography or lack of resources. More consumers can access low-cost or free tools and information online.

- Empowered Consumers: As more people take ownership of their health data, they are motivated to take a more active role in their well-being.

- Behavioral Change: Stakeholders are already experimenting with new ways to encourage healthy habits, for example. Gamification and reward of desired behaviors can result in positive behavior change.

- Scientific Breakthroughs: One silver lining in the storm clouds of the pandemic is the streamlining of the regulatory processes for market approval. Technology will also accelerate the rate of new advances and inventions.

Finally, oncology medical device manufacturers should also view future trends through the lens of global pandemic learnings, too.

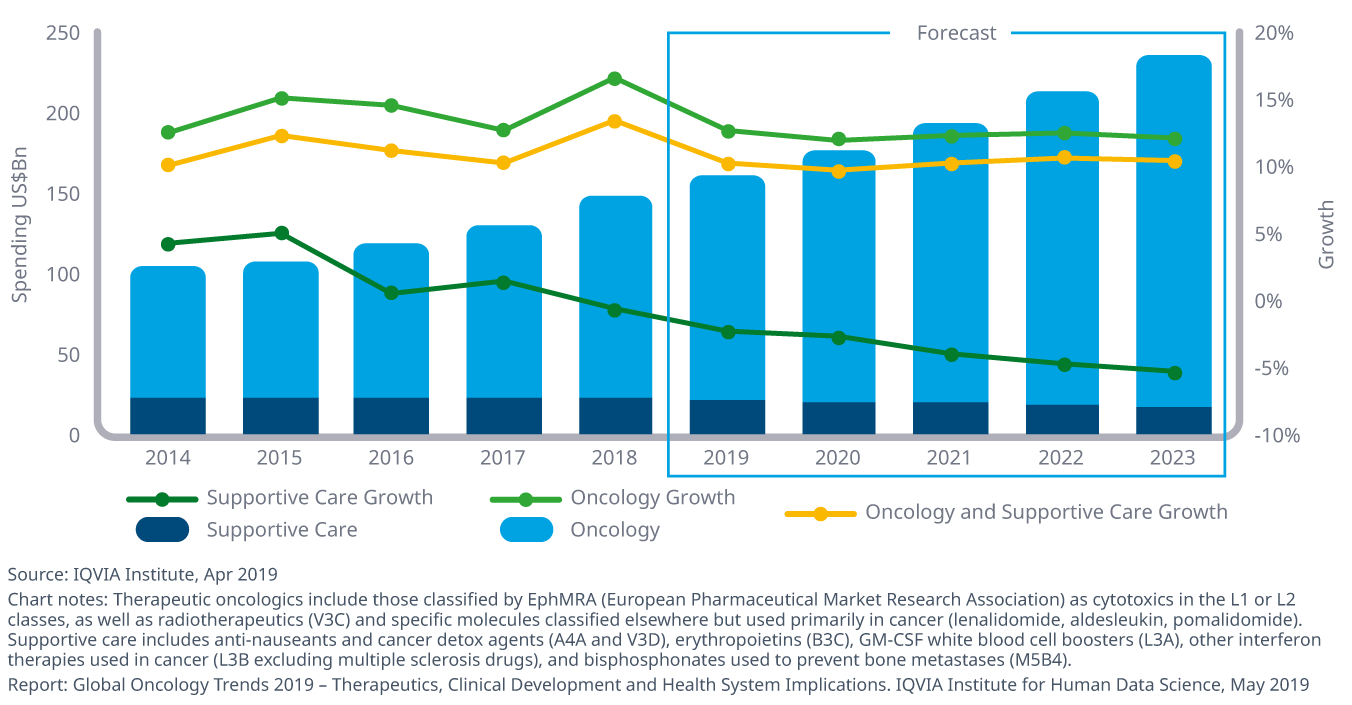

Global Spending on Oncology

Global spending on oncology, including supportive care, continues to increase. In 2021, global oncology spending totaled 187 billion U.S. dollars. In comparison, costs stood at 86 billion dollars six years earlier.

Current Trends in Oncology Medical Device Market

Researchers expect the US global oncology devices market size to grow from $91B in 2021 to $216.35 billion in 2026, at a CAGR of 19%. In 2021, North America was the largest in the global market, with the Asia Pacific second.

In 2014 the elderly represented nearly one-third of the total US healthcare consumption. Older people get cancer at higher rates than the general population. The increase in the elderly population has obvious implications for Medicare and legislative oversight going forward, which also affects the medical device landscape.

The older population is expanding on a global scale as well. The United Nations and U.S. Census Bureau project the global elderly will increase from 8% of the population in 2015 to about 18% by 2060.

More potential patients globally do not necessarily translate to more demand for current devices. Low per capita expenditure on healthcare in developing countries limits the demand for expensive oncology devices. Having said that, rising cancer rates in those countries represent a huge opportunity for low-cost innovations.

Artificial intelligence (AI), data interoperability, and improved tools for analyzing Big Data will enable health care providers to provide more personalized treatment plans for cancer patients. Share on XCancer Diagnostics

The global cancer diagnostics market size in 2021 was $17.2B and is expected to grow at a CAGR of 11.5% from 2021 to 2026. The increasing incidence of cancer and the number of private diagnostic laboratories are two factors driving growth. In an effort to ease the burden on public hospitals from the growing demand for cancer diagnostic imaging, companies are opening private diagnostic centers around the globe.

Within the 2020 cancer diagnostics tech market, IVD testing segment held the largest market share over imaging-based and biopsy techniques.

Analysts also expect diagnostic consumables to grow at a higher rate than instruments.

As for as end-users, hospitals make up the largest segment, driven by more patient visits, more in-hospital diagnostic procedures, and more compliance with screening leading to early diagnosis.

In fact, screening represents an area of opportunity for medical device manufacturers. As programs like the Cancer Moonshot show, governments in some countries are joining primary care doctors in recommending cancer screening tests for patients.

Key Players in the Oncology Medical Device Market

Some of the major players operating in this market are GE Healthcare (US), the market leader in 2020, buoyed by a strong brand and a comprehensive cancer diagnostics product portfolio. Becton, Dickinson, and Company (US) was second in the market.

Additional companies in the space include Eckert & Ziegler BEBIG, Oncura Inc, Medtronic plc, Varian Medical Systems Inc, Elekta AB, Theragenics Corporation, Accuray Incorporated, Roche Diagnostics, and IBA Group.

Looking Ahead

The cancer sector represents many current and future opportunities for oncology medical device startups and manufacturers. While demographic data is helpful, executives and entrepreneurs can identify specific opportunities by looking at trends beyond age cohorts. Contact us to start the conversation with an experienced provider.