Update on Diabetes Sector for Medical Device Manufacturers

Despite ongoing challenges, the beginning of the 21st century showed some good news in one area of global development. Since 1990, economic progress lifted more than 1.2 billion people out of extreme poverty. While the middle class is shrinking in the United States for the first time in decades, analysts expect the global middle class to increase rapidly by 2030.

Increased spending power can have its downsides. Globalization, economic growth, and a higher standard of living means families and individuals have greater access to processed foods and sedentary lifestyle choices. At the same time, people are living longer. Unfortunately, what we are seeing is a combination of unhealthy habits and longer life spans that, if trends continue, will contribute to a global rise in diabetes, especially type 2.

Type 1 diabetes accounts for 5-10% of all cases. Doctors believe that an immune reaction causes the disease and that genes and environmental factors both play a part in the likelihood of developing the disease. There is no known cure or fail-safe preventive measure for type 1 diabetes.

The risk for type 2 diabetes includes obesity, age, family history, sedentary lifestyle, and ethnic background. Lifestyle changes such as exercise and healthy eating can improve patient outcomes, especially for those with type 2 diabetes.

Unfortunately, researchers expect both types of diabetes to increase both in the US and globally over the next few decades. Let’s look at some trends and predictions.

Diabetes Statistics and Trends

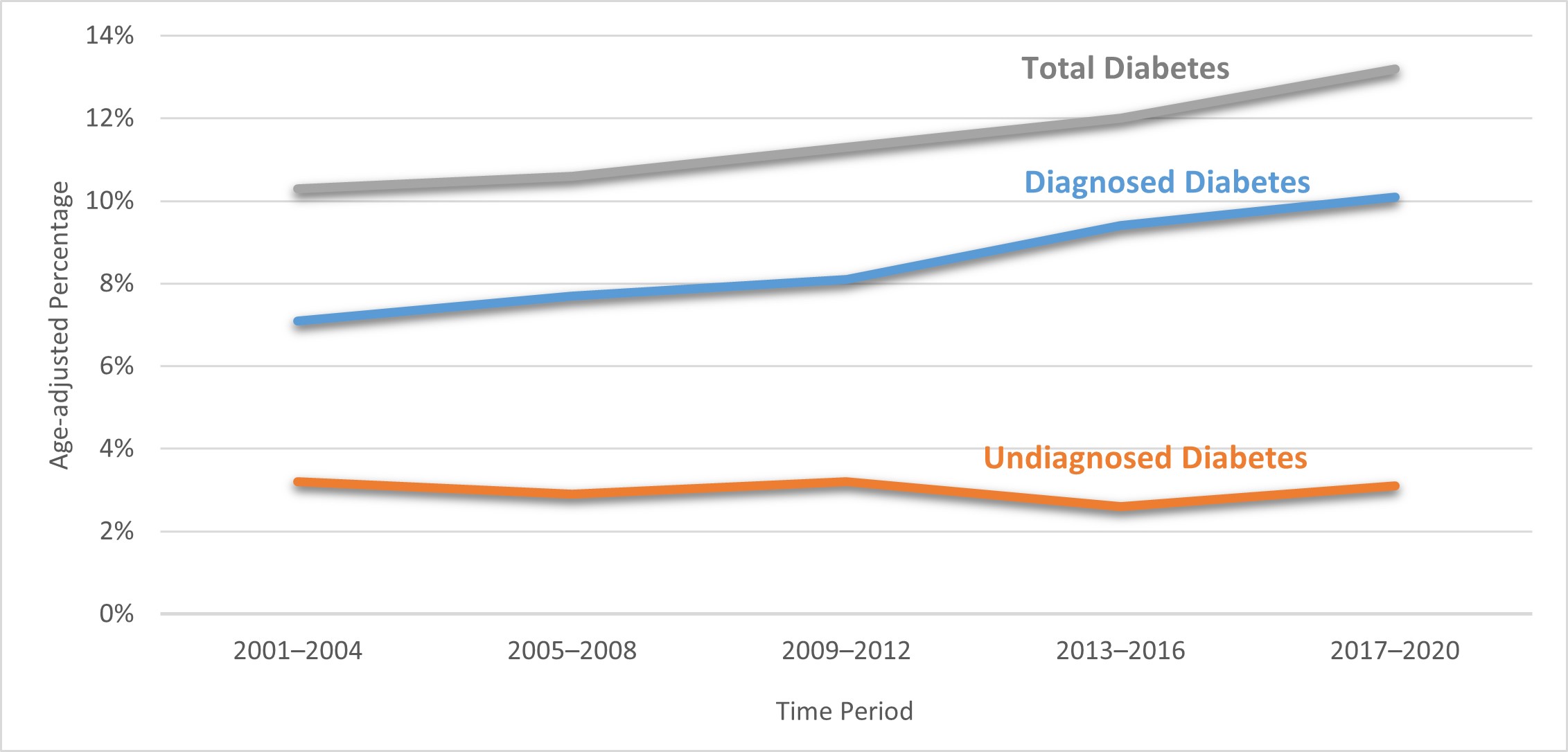

In 2022, 10% of the US adult population has diabetes. The CDC expects that number to increase over the next 40 years, partially due to an aging population and an increase in at-risk minority groups.

Unlink some other diseases, socioeconomic factors tend to influence the prevalence of diabetes. In 2022 for the first time, the CDC released numbers correlating diabetes not only with ethnicity but with poverty and education levels as well. For example:

- In 2018-2019, the percentage of adults diagnosed with diabetes was highest among American Indian and Alaska Native persons (14.5%), non-Hispanic Black people (12.1%), and people of Hispanic origin (11.8%), followed by non-Hispanic Asian people (9.5%) and non-Hispanic white people (7.4%).

- Both men (13.7%) and women (14.4%) with a family income below the federal poverty level had the highest prevalence of diabetes.

- People with less education were more likely to be diagnosed with diabetes.

The prevalence of diabetes in U.S. adults could rise to 1 in 3 by 2050 if current trends continue, with the number of new diabetes cases each year increasing from 8 per 1,000 people in 2008, to 15 per 1,000 in 2050.

On a global scale, the World Health Organization (WHO) estimates that 422 million people have diabetes. Developing countries are seeing increases in diabetes due to changes in eating habits and lifestyle choices as well. People are also living longer in general, and those with diabetes are learning how to manage their symptoms.

However, medical device innovation is evolving rapidly as the modern lifestyle becomes digitized and companies and providers learn how us AI to extract meaning from large datasets and deliver more personalized solutions for patients.

Emerging Trends in the Diabetes Medical Device Market

Several emerging trends will affect the diabetes medical device market.

- Machine learning, artificial intelligence, and big data: Machine learning and algorithms interpret data to help providers collaborate on more personalized care plans. Genetic sequencing can also lead to personalization based on a patient’s genotype.

- Telehealth: Aligning with the general shift toward healthcare delivery outside of traditional Healthcare Delivery Organizations (HDOs), diabetes patients and providers can communicate via messaging, voice and video.

- Collaborative care platforms: Online platforms enable sharing of information and real-time feedback, as well as access to a supportive community around their disease.

- Smart devices: Mobile apps and wearables allow patients to continuously monitor their vital signs and share data with their providers.

- Non-invasive insulin delivery: In the past insulin was delivered via a painful intramuscular injection. Non-invasive delivery methods represent a lifestyle and comfort improvement for patients, creating greater demand for devices such as high-end insulin pumps and pens.

- Automated self-care tasks: All diabetics have to perform the same general routine to monitor glucose and administer insulin to keep blood sugar levels in a safe range. Routine basics can be automated in a closed-loop system for better long-term consistency and longer life span.

Diabetes Medical Devices Market Size

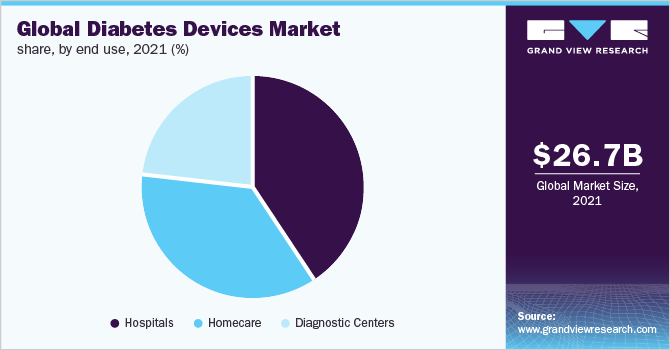

The 2020 global diabetes devices market was US$ 26.7B. Analysts predict it will surpass around US$ 48.8B by 2030, growing at a CAGR of 6.2% from 2021 to 2030. Crucial factors accountable for market growth are:

- Growing incidence of diabetes

- Growing public awareness regarding diabetes

- Unhealthy habits with poor food and a sedentary lifestyle

- Increasing diabetic population and diagnoses in developing nations

- The rapid growth of online pharmacy options

- Technological advancements in diabetes management

- Aging population in developed countries

Of the HDOs serving diabetic patients, the hospital segment dominated the market with the largest market share of 40.9% in 2021.

Global Spending on Diabetes

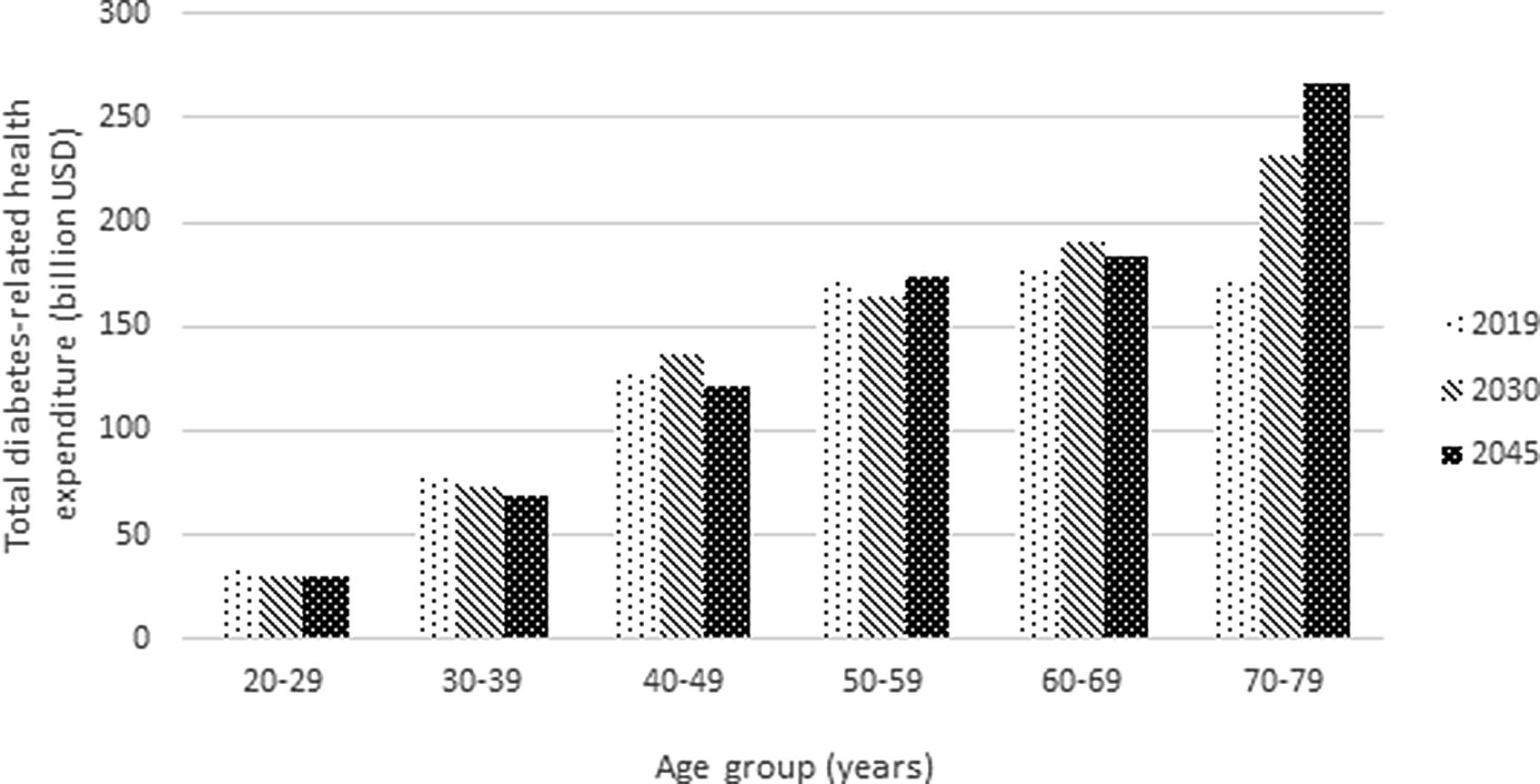

Global spending on diabetes continues to increase, especially among the older population. By 2030 researchers predict diabetes-related health expenditure for those aged 70–79 years will exceed that in all age groups. Medical device manufacturers may find differentiation opportunities in devices tailored to integrate with geriatric care, home health, and nursing home environments.

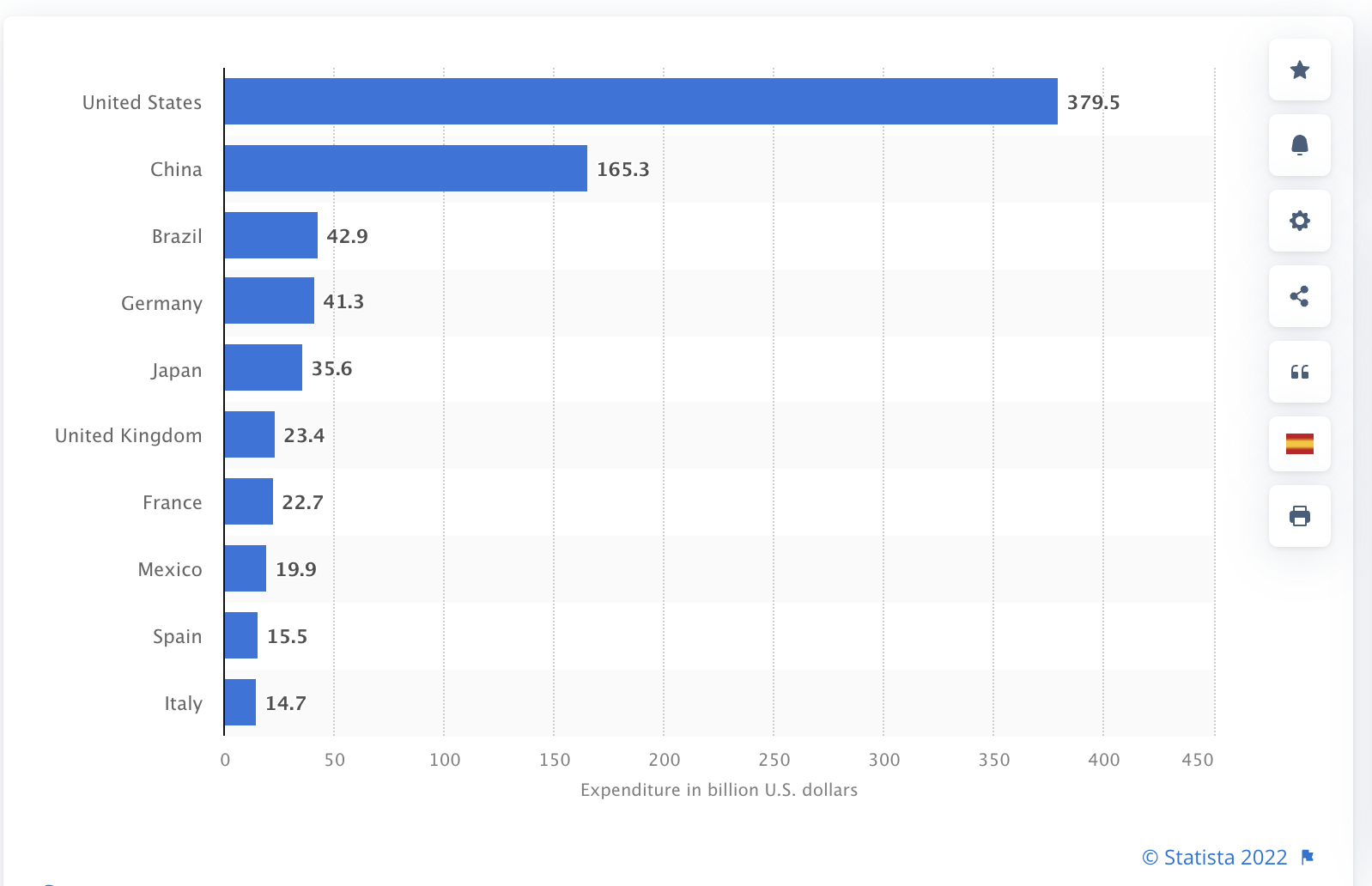

As far as total spending on diabetes, the United States’ diabetes health expenditure dwarfs that of most other countries. The US spends more than double the amount of China, the second of the top 10 countries for diabetes health expenditure.

Top 10 countries based on diabetes health expenditure in 2021

(in billion U.S. dollars)

Key Players in the Diabetes Medical Device Market

Companies in the diabetes MDM are implementing strategic acquisitions and alliances to increase competitiveness and market share.

In February 2019, Abbott and Novo Nordisk entered into a non-exclusive partnership to help in improving digital solutions for diabetes. The partnership enables the integration of data, which allows healthcare professionals to analyze glucose and insulin data together.

In November 2020, Novo Nordisk also acquired Emisphere Technologies, a drug delivery technology company to help Novo Nordisk increase competitiveness in the oral antidiabetic market.

Some additional companies operating in the diabetes devices market include:

- Medtronic plc

- F.Hoffmann-La-Ltd.

- Bayer AG

- Lifescan, Inc.

- B Braun Melsungen AG

- Lifescan, Inc.

- Dexcom Inc.

- Insulet Corporation

- Ypsomed Holdings

- Companion Medical

- Sanofi

- Valeritas Holding Inc.

- Arkray, Inc.

Looking Ahead

The diabetes sector represents many current and future opportunities for diabetes medical device startups and manufacturers. While demographic projections based on past trends are helpful, executives and entrepreneurs should also keep an eye on other trends in personal health, such as Medtech and lifestyle. Public health initiatives and even food industry regulation can affect the prevalence of diabetes in ways that may be difficult to predict at this moment.

In many other diseases, such as cancer, patients have limited control over their outcomes. Diabetes is one case where a significant shift among patients to better lifestyle choices may result in lower demand for diabetes medical devices. Or, as we are seeing in the projections above, the opposite is, unfortunately, true as well.

Do you have questions about this sector or bringing diabetes medical devices to market? Contact us to start the conversation with an experienced provider.