The 2025 Roadmap to Funding: Essential Steps for Medical Device Startups

Bringing a medical device startup to market is challenging yet rewarding. From regulatory hurdles to securing funding, founders must navigate a complex landscape to transform their innovative ideas into viable medical solutions.

One of the most critical aspects of this journey is securing the necessary capital to fund research, development, and commercialization efforts. Even the most groundbreaking medical device innovations can struggle to gain traction without a well-structured funding strategy.

As technology accelerates, the investment climate for medical device startups also continues to evolve in 2025. Investors seek startups that demonstrate technological innovation, regulatory preparedness, and a clear path to market entry. This guide outlines the essential funding steps for medical device startups, equipping founders with the knowledge and strategies to attract investors and secure financial backing.

Preparing for Investor Engagement

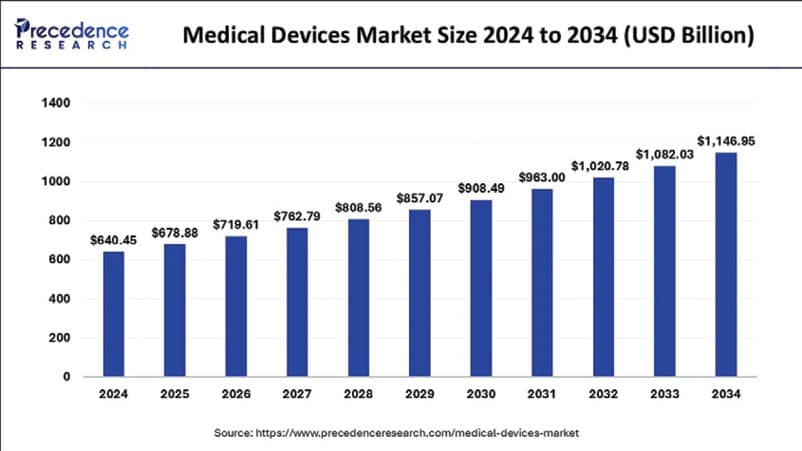

The global medical devices market is on a steady climb, valued at $640.45 billion in 2024 and expected to hit $678.88 billion by year’s end, according to Precedence Research. Looking ahead, the industry is projected to surge to nearly $1.15 trillion by 2034, fueled by a 6% compound annual growth rate (CAGR).

Source: Precedence Research

Zooming in on North America, the market stood at $256.18 billion in 2024 and is set to expand at a CAGR of 6.05% over the next decade. The U.S. leads the charge, with its medical devices market valued at $180.02 billion in 2024 and forecasted to reach an impressive $328.65 billion by 2034, growing at a CAGR of 6.2%.

With innovation and demand driving growth, the industry’s future looks stronger than ever.

Of course, that doesn’t mean that fundraising will ever be simple. Before approaching investors, medical device startups must ensure they are investment-ready. Investors require a solid foundation with a clear value proposition, regulatory preparedness, and a strong commercialization strategy. Here are the essential steps to take before seeking funding:

1. Develop a working prototype.

A functional prototype is crucial for demonstrating the feasibility of your medical device. Investors want to see a tangible product that showcases the core technology and its potential impact on patient care. Having a prototype helps build credibility and can significantly increase investor confidence.

2. Establish regulatory and compliance strategies.

Medical devices must adhere to strict regulatory standards set by agencies such as the FDA and the European Medicines Agency (EMA). Investors look for startups with well-defined regulatory pathways, including plans for clinical trials, regulatory submissions, and compliance with industry standards. Demonstrating awareness of regulatory requirements reassures investors that your device can successfully reach the market.

3. Conduct market research and validation.

Aside from clinical trials to satisfy regulatory requirements, investors also need evidence that your medical device has a viable market. Conducting thorough market research, including competitive analysis and patient demand assessments, helps validate your product’s potential. Gathering feedback from healthcare professionals, hospital administrators, and potential end-users further strengthens your investment pitch.

4. Start building key relationships as soon as possible.

No matter what market or scenario your device will serve, you will need to have relationsjhips with key stakeholders such as Health Delivery Organizations (HDOs), reimbursement and regulatory consultants, and manufacturing contacts. Don’t wait until you need key people in your network to start cultivating them.

5. Build a strong business plan.

A well-structured business plan is essential for investor engagement. It should outline your business model, revenue projections, commercialization strategy, and financial forecasts. Investors want to see a clear roadmap for how their investment will contribute to the startup’s success and generate returns.

5. Protect Intellectual Property (IP).

Intellectual property protection, such as patents and trademarks, is critical in the medical device industry. Investors are more likely to fund startups with strong IP portfolios, as this provides a competitive edge and prevents competitors from replicating the technology. Ensuring your innovations are legally protected enhances the attractiveness of your startup to potential investors.

By following these steps, medical device startups can significantly improve their chances of securing funding. The following section will explore different funding sources and how to identify the right investors for your business.

Identifying Funding Sources

Securing funding for a medical device startup requires understanding the financing options and selecting the best fit for your business model and growth stage. Here are key funding sources to consider:

1. Venture Capital (VC) Funding

Venture capital firms specialize in high-growth startups with strong market potential. VC funding provides financial resources, strategic mentorship, networking opportunities, and industry connections. However, securing VC investment requires demonstrating scalability, market demand, and a well-defined business strategy.

2. Government Grants and Non-Dilutive Funding

Many government agencies, such as the National Institutes of Health (NIH) and the Small Business Innovation Research (SBIR) program, offer grants specifically for medical device startups. These grants provide non-dilutive funding, meaning founders do not have to give up equity. Startups should research available grant programs and tailor their applications to meet eligibility requirements.

3. Angel Investors

Angel investors are individuals who invest in early-stage startups in exchange for equity. Unlike VCs, angel investors may have a higher risk tolerance and be more willing to invest in innovative medical technologies. Networking at industry events and joining startup accelerators can help connect founders with potential angel investors.

4. Accelerators and Incubators

Startup accelerators and incubators provide funding, mentorship, and resources to help medical device startups refine their products and business strategies. Programs such as Y Combinator, MedTech Innovator, and JLABS offer early-stage funding and access to expert guidance, making them valuable options for emerging startups.

5. Crowdfunding and Alternative Financing

Equity crowdfunding platforms enable startups to raise capital from a broad pool of investors. Revenue-based financing or partnerships with established healthcare companies can provide alternative funding pathways. Exploring these options can supplement traditional investment methods.

Selecting the right funding source depends on the startup’s stage of development, regulatory progress, and financial needs. A diversified approach that combines multiple funding sources can increase the likelihood of securing the necessary capital.

Common Mistakes to Avoid During Fundraising

While fundraising is essential for growth, many medical device startups make critical mistakes that hinder their chances of securing investment. Avoiding these pitfalls can streamline the funding process and improve investor confidence.

1. Lacking a clear regulatory strategy.

Investors need to see a well-defined regulatory plan that outlines steps for obtaining FDA or CE mark approval. Startups that fail to address compliance early on may struggle to gain investor trust and funding.

2. Overlooking market validation.

Founders who fail to demonstrate market demand risk losing investor interest. Conducting thorough market research, securing early adopters, and gathering feedback from healthcare professionals can strengthen investor confidence.

3. Unrealistic financial projections.

Overly optimistic revenue projections without substantiated data can deter investors. Transparent, well-researched financial forecasts that align with industry benchmarks are essential for credibility.

4. Weak Intellectual Property (IP) protection.

Startups that do not secure patents or have a weak IP strategy risk losing competitive advantage. Investors seek companies with strong IP portfolios that provide defensibility in the market.

5. Inadequate pitch preparation.

A poorly structured investor pitch can make or break funding opportunities. Founders must craft compelling presentations communicating their value proposition, market potential, and financial strategy.

Use this list as a guideline to improve your fundraising efforts and enhance your startup’s appeal to investors.

How Galen Data Can Help

Regardless of how your startup raises funds, the road from idea to market for advanced medical devices is complex and expensive. You need an experienced partner in data management for regulatory compliance and proof of progress

At Galen Data, we understand the unique challenges of medical device data and have the cloud expertise to help you navigate them.

Partner with Galen Data today to:

- Develop a secure and scalable data management plan.

- Leverage our expertise in medical device data and compliance.

- Focus on innovation while we handle the infrastructure.

Schedule a call with us today to discuss your specific needs and see how Galen Data can help you store, manage, and secure your medical device data at scale.