The 3 Biggest Post-COVID19 Trends Affecting the Medical Device Industry

The global pandemic caused an earthquake in the health care sector that will produce aftershocks for years to come. Demand for some items, like masks and protective equipment, quickly exceeded supply. Medical devices associated with optional procedures experienced a lull as consumers and patients canceled non-urgent and preventive care appointments.

In 2022, the medical device industry is seeing the first phase of a new landscape. Three major trends affecting medical device manufacturers for the next few years are supply chain, demand changes in certain product categories, and technology. Share on X

Let’s look at each in more detail.

Supply Chain Trends for Medical Devices

One of the biggest challenges for healthcare organizations during the global pandemic was the disruption of global supply chains. As the virus spread like wildfire, we saw stories that seemed surreal about the lack of masks and protective equipment for medical workers.

While the initial mask crisis is past, shortages are worsening by spreading across medical device and supply categories. Large healthcare logistics firm Owens & Minor reports that 45% of the items it distributes are now supply-constrained.

Computer Chip Shortage

Medical device makers compete with automakers and global consumer electronics manufacturers for computer chips. Currently, the medical technology industry represents 1% of the current total chip supply. Estimates project the industry demand for chips will double between 2021 to 2028. (source)

While 1% is a small proportion of total supply, the question is not in quantity but use case and mitigating unacceptable risk. It’s one thing to have delays and shortages with smartphones or cars, it is another to have patients’ lives at risk due to chip shortages. For this reason, the European Commission issued a recommendation for its Member States to study chip shortages and prioritize supplies for the healthcare sector. In the United States, some medical device industry groups are seeking priority from suppliers as well.

Product Trends

The countries that spend the most on healthcare are also the ones with aging populations, increasing lifestyle disease rates, and higher overall demand for healthcare services. At the same time, these countries are experiencing a shortage of healthcare workers. Converging trends are affecting medical device product segments in the following ways:

Diagnostic Testing

With the shortage of healthcare personnel, the demand for at-home or more rapid testing in the office is increasing. One obvious example is over-the-counter COVID-19 tests, both antigen and molecular. Consumer interest is increasing for at-home kits for screening or diagnosis before making an appointment or trip to the doctor’s office. Some analysts believe the FDA is setting the stage to accelerate diagnostic testing approvals in the coming years.

Diabetes

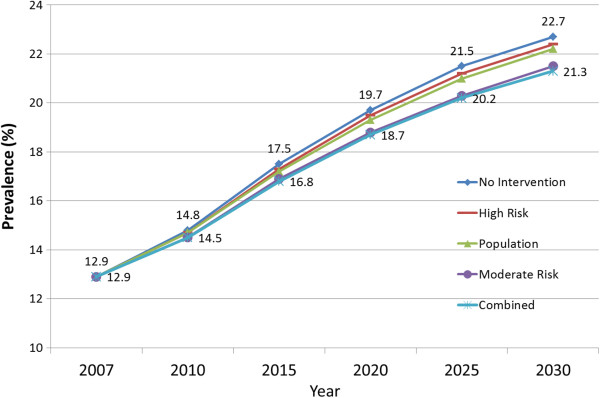

Unfortunately, many studies predict that diabetes will increase in the US and many countries in the coming years.

Diabetes Prevalence Rates 2007 – 2030

Diabetes is among the top 10 causes of death in adults. Aging populations and obesity contribute to increasing rates of diabetes T2D, which accounts for about 90% of the total cases.

For this reason, diabetes is an opportunity in MedTech for devices that improve patient outcomes and improve efficiency for understaffed health delivery organizations (HDOs).

Current areas of innovation include insulin pumps and continuous glucose monitor (CGM) sensors. Two companies working on advanced algorithms for insulin management are Dexcom and Insulet. Diabetes device makers are also making meaningful progress in treating patients earlier in their disease progression.

3D Print Technology

The 3D print technology makes it possible to create, on-site, customized prosthetics and surgical tools. The technology also has major implications for medical device prototyping research as well as augmenting dentistry and orthodontics design.

Medical device companies have developed printers that can print living tissue. Using bio-ink, which is an organic, living material, 3D printers are printing new tissues and will eventually print body parts. Eventually, we won’t have to rely on donors to replace vital organs.

Increasing Demand for Medical Wearable Technology

Interest in wearable technology, like smartwatches, jewelry, and clothing, is growing as more consumers realize that technology can give them new insights and a consistent stream of data about what’s happening inside their bodies.

In 2019, North America had the highest share in the global wearable medical device market, at 36.1%, driven by burgeoning demand in the US. The US market for wearable medical devices in 2018 was US$ 24,571.8 Mn and is forecast to grow to US$ 139,353.6 Mn by 2026.

Health care providers are also capitalizing on the opportunity to remotely monitor a patient’s condition before and after treatment in hospitals, outpatient centers, or the doctor’s office.

As devices proliferate, patients and health care providers want a seamless experience. Device bundles that automatically coordinate technology to produce valuable insights will stand out as more desirable to consumers and healthcare providers.

Many providers are looking beyond single medical devices as a standalone offering. One source says healthcare companies are looking for a portfolio of coordinated devices backed by robust AI to “act as a solution to a disease state challenge.”

HDOs are sending some patients home with Remote Patient Monitoring (RPM) kits as part of outpatient care protocols. An RPM can be a bundle of devices used to monitor patient health at home or work. RPM devices are also showing up in consumer outlets like drug stores and online shopping marketplaces.

Technology

Technology is the third major trend accelerating in the medical device space, reflecting the digitization of all industries in a globally connected marketplace.

Cloud Computing

In this age of distributed and collaborative business models, cloud computing is gradually gaining popularity in the digital workforce. Many industries have either completely moved or have moved most of their processes to the cloud.

Cloud platforms are gaining traction in the medical device industry to provide a shared platform with workflow automation, comprehensive product development, and unified data. The cloud facilitates improved data flow across stakeholders by breaking down data silos. Cloud-drive solutions can help medical device enterprises become more scalable and efficient.

Artificial Intelligence

Longer life expectancy and increased incidence of lifestyle diseases are creating a growing demand for health care services and workers in the industry. High costs and operational inefficiencies are a challenge as well. These factors create a demand for artificial intelligence (AI) powered devices and machine learning for making decisions in ways that approximate human intelligence and behavior.

Medical devices are subject to strong regulatory standards that give reasonable assurance of their safety and efficacy. AI can be used to speed up the regulatory process by extracting relevant insights from patterns in vast data sets and performing advanced analytics with different variables, possibly decreasing inspection times.

AI can be a significant innovation in a highly regulated industry like medical devices by augmenting reporting for the regulatory process as well as improving the operational efficiency of devices in the field.

Personalization and Hyper-Segmentation of Consumers

As providers collect more extensive data sets, diagnoses become more personalized and predictive. Benefits may include early detection, which leads to better patient health outcomes and cost savings for everyone.

Personalization depends on applied technology, AI’s time to learn (experience), and data, of course. For more than a decade, Amazon and other non-healthcare companies developed data platforms and used machine learning to improve personalization for customers.

Within the boundaries of privacy regulations, we can expect to see similar improvements in customer data platforms for healthcare companies, aided by expertise from crossover non-healthcare companies such as Adobe and Salesforce.

One welcome sub-trend related to personalization is hyper-segmentation of patients in traditionally underserved cohorts. Devices now gather data from patients not reflected in legacy studies, such as minorities, LGBTQ individuals, women, and other traditionally underserved communities. AI enables providers to develop personalized treatment plans customized for indicators unique to those communities.

Looking Ahead

COVID-19 and variants will likely be a risk for years to come. Analysts caution that some sectors in the medical device arena are at a higher risk from COVID pressures, such as elective procedures and sub-sectors like cardiology, ophthalmology, and orthopedics.

Digital innovation is the meta-trend for the medical device industry, especially in compliance and product lifecycle management (PLM). With growing patient demand, increasing costs, and a shrinking workforce, AI and digital innovation will be critical for increasing operational efficiency, worker productivity, and risk management.

Which trend do you see as most important for your business this year? Knowing where to start creating a strategy can seem daunting. Gartner and other strategy companies provide simplified templates that may be helpful to get you started. And of course, if you have any questions about the compliance and data landscape for 2022, we are here for you.