The New Normal Supply Chain – Challenges and Strategies for Medical Device Manufacturers

The global shockwaves from the COVID-19 pandemic working their way through the healthcare sector are sure to create a ripple effect for some time. One thing is clear – there is no quick resolution and medical device companies are feeling the pinch.

While the initial PPE crisis for hospitals has passed, shortages are worsening across other supply categories. Large healthcare logistics firm Owens & Minor reports that 45% of the items it distributes are now supply-constrained.

The challenge is especially acute because demographic trends and innovative technologies were boosting demand for medical devices even before the pandemic. The good news is that government and industry stakeholders are taking steps to mitigate the current situation where possible and strengthen the long-term response to supply chain threats.

Let’s look at the current snapshot of the situation and some strategies for moving forward.

Current Issues with Medtech Supply Chain

Supply chain shortages cut across industries when finished products for different markets use the same materials or parts in the manufacturing stage.

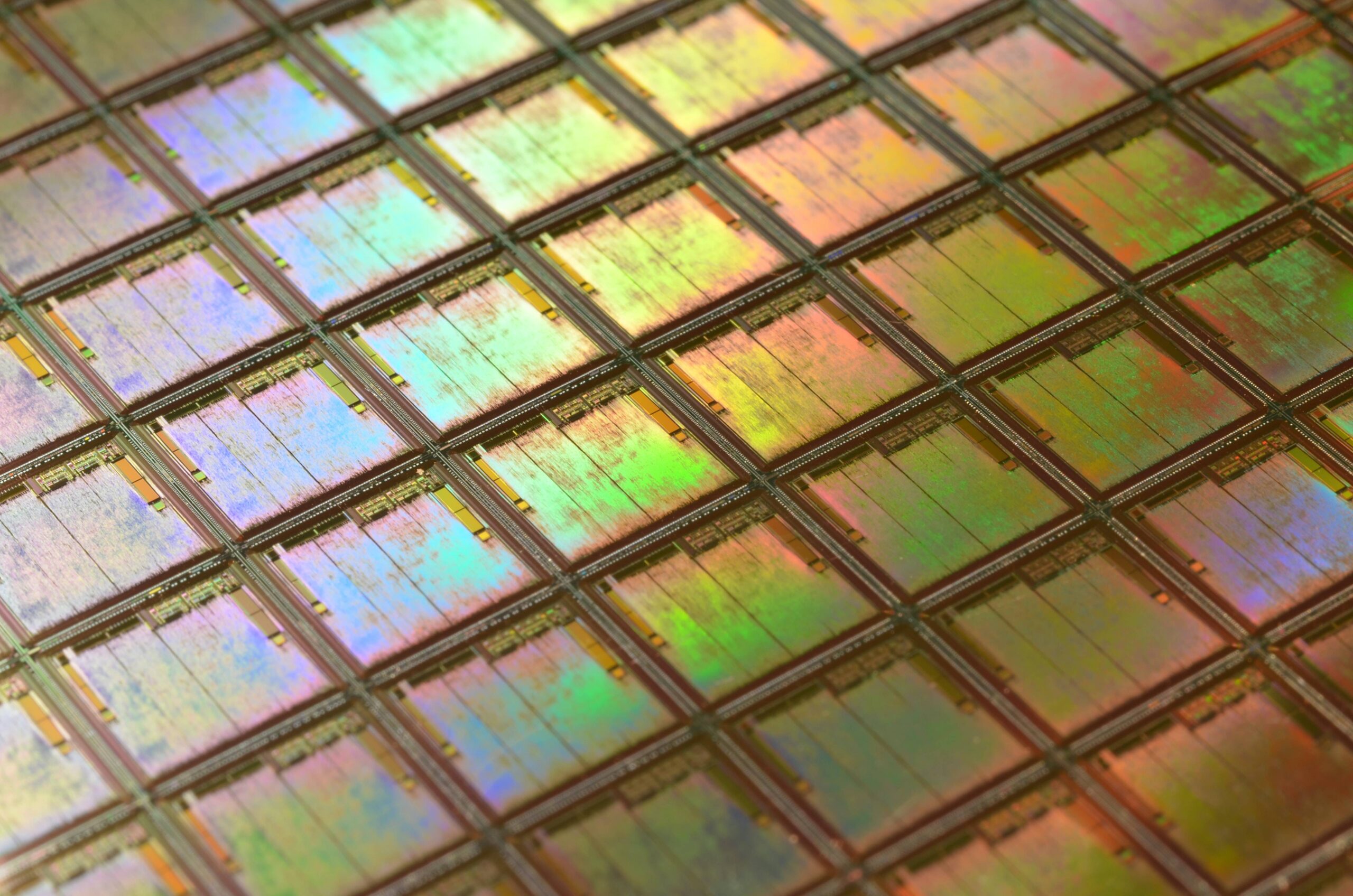

The most urgent example for Medtech is semiconductor chips. Industry analyst George Calhoun, director of the Hanlon Financial Systems Center, points out that even before the global pandemic, chip manufacturing logistics had become so complex that “ecosystem” is now a better metaphor than supply chain.

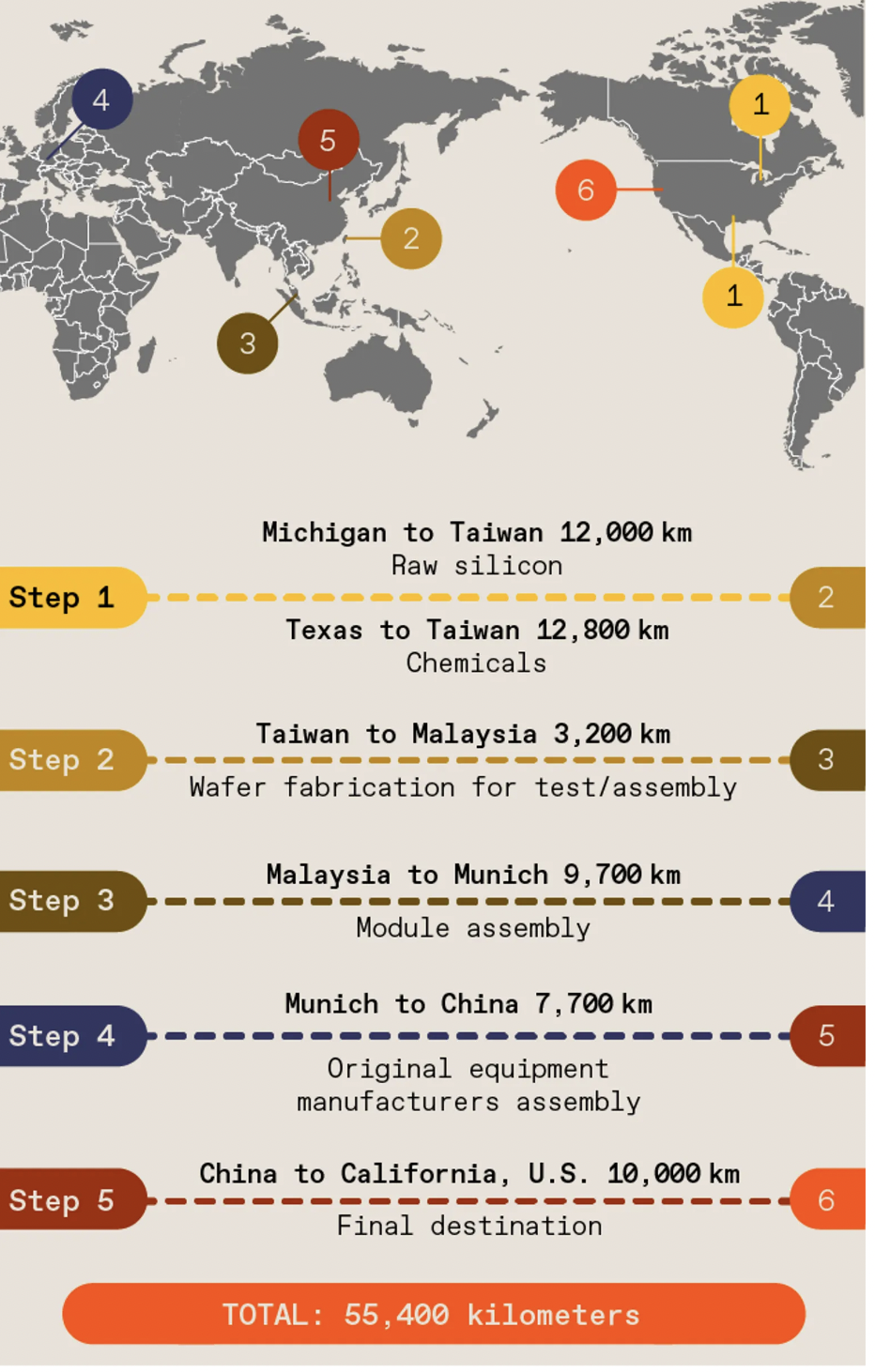

Complexity across borders increases vulnerability in the flow. The components in a semiconductor can travel well over 50,000 kilometers and cross more than 70 international borders before a chip finally reaches its end customer. This graphic shows an example of the global semiconductor manufacturing journey.

Semiconductors for Medtech

Medical device manufacturers compete with automakers and global consumer electronics manufacturers for computer chips. Currently, the medical technology industry represents 1% of the current total chip supply. Estimates project the industry demand for chips will double between 2021 to 2028.

While 1% is a small proportion of total supply, the question is not in quantity but in use case and mitigating unacceptable risk. It’s one thing to have delays and shortages with consumer electronics or cars, it is another to have patients’ lives at risk due to chip shortages. As Forbes recently pointed out:

“The burgeoning number of electronic devices in healthcare has left items including defibrillators and imaging machines vulnerable to the same supply shocks as consumer electronic devices.” (Forbes)

The chip shortage affects devices like ventilators, defibrillators, imaging machines; ECG, EEG, glucose and blood pressure monitors; implantable pacemakers, and more. Medical device manufacturers must also compete with large companies in the other sectors for sufficient supplies of plastic derivatives such as resins and polymers.

Increased demand in the global semiconductor market was causing strain prior to the pandemic. Logistics complexity is pushing the limits of the production benefits of globalization. For example, only three Tawainese firms produce over 90 percent of the world’s most advanced (5-nanometer and 7-nanometer) semiconductors. The United States and other countries are rethinking their dependency on a shaky global supply chain in such a critical sector.

Trends for the Near Term

The long-term goal of a more secure balance between domestic and foreign semiconductor production will not appear overnight. The Semiconductor Industry Association (SIA)’s 2021 report estimates that creating a self-sufficient US-based semiconductor supply chain could take 10 years, cost $1T, and increase semiconductor prices by up to 65 percent.

In the meantime, the European Commission issued a recommendation for its Member States to study chip shortages and prioritize supplies for the healthcare sector. In the United States, some medical device industry groups are seeking priority from suppliers as well.

Congress is poised to fund a US $52B silicon incentive package to increase US semiconductor manufacturing as part of the America COMPETES Act. While that seems like a lot of money (GM’s 2014 bailout amounted to about $50 B), industry analysts agree that the package is not meant to be a long-term answer. It signals support for the issue as private industry investment in domestic fabrication is already dwarfing that amount.

In January 2022 the SIA announced nearly $80B in new investments in the US for 2021- 2025, including a $17B Samsung factory in Texas, $30B in investments from Texas Instruments, and more. Intel suggests its Ohio plant may grow to a $100B investment over the next 10 years via public/private partnerships.

Globally, Calhoun predicts that private-sector will invest over $850B to solve the chip shortage in the years ahead.

NASEM Recommendations for a More Resilient Supply Chain

In 2020, the National Academies of Sciences, Engineering, and Medicine (NASEM) studied product shortages and options to improve medical supply chains overall. Its 364-page report called for the following actions:

- Task the FDA to establish a public database and publicly track sourcing, quality, volume, and capacity information

- Inclusion of failure-to-supply penalties in healthcare system contracts.

- Federal government oversight to optimize inventory stockpiling to respond to medical-product shortages.

FDA Action for Supply Chain Resiliency

In March 2020, new federal legislation granted the FDA authority to prevent or mitigate medical device shortages before or during public health emergencies such as COVID-19. Earlier this year, the FDA published new guidance on reporting and notification requirements for specified medical device manufacturers who need to cease or suspend production during public health emergencies.

The two types of devices are:

- Life-supporting, life-sustaining, or intended for use in emergency medical care settings.

- Devices that provide data the FDA deems necessary related to potential supply disruptions during or before a public health emergency.

Medical device manufacturers that fall into those categories must notify the FDA in the following situations:

- Plans for permanent discontinuance of devices must be reported to FDA six months in advance or as soon as practically possible, but no later than seven days following a decision to permanently discontinue a device.

- Medical device manufacturers experiencing or anticipating interruptions should notify FDA no later than seven days after the occurrence of an interruption.

Medical device manufacturers or startups working on technology that could be considered crucial for public health emergencies should plan for these additional reporting requirements.

What additional company-level strategies should medical device manufacturers be considering for dealing with ongoing supply chain challenges?

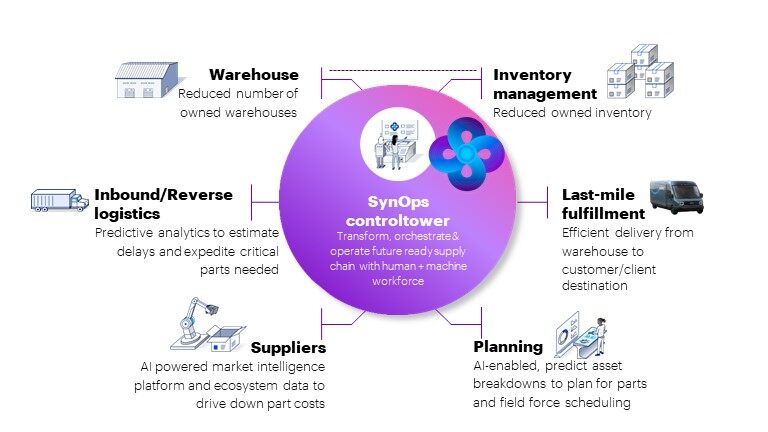

Just as the “supply chain” metaphor for global logistics is moving toward an ecosystem model, proposed solutions for Medtech include creating a “future-ready” supply ecosystem of partners and technology along an end-to-end digitized process.

Proposed solutions for Medtech include creating a “future-ready” supply ecosystem of partners and technology along an end-to-end digitized process. Click To TweetThese resilient ecosystems leverage AI, cloud, IoT technology, data analytics, and automation to flag problems earlier and remove friction at different points that now cause delays. The graph below gives an overview of a future-ready supply ecosystem.

Moving Ahead

Medtech and the medical device industry are at an unusually disruptive point in time. While executing established strategies is important, now is a great time for medical device manufacturers to pause and look above the fray.

Are there changes to your connectivity plans that would benefit your market positioning in the evolving future-ready supply chain? It is clear that a big part of the solution going forward is robust tech and public/private partnerships. Galen has been helping medical device manufacturers with their connectivity and go-to-market strategies since 2016. Feel free to reach out today.