The Evolution of the Smart Home Health Hub

Technology is busily disrupting traditional boundaries and silos in all areas of our lives. Before laptop computers, white-collar workers did most of their work at an office. Networking took place in person and around the water cooler. In today’s post-pandemic, remote hybrid world, we mostly carry out our work and social life via our phones and laptops.

Medical care is experiencing a similar decentralization.

The recent pandemic accelerated trends in regard to home care, an early shove into a looming trend toward increased demand for remote care solutions. Share on XTrends Driving the Home Healthcare Market

The global home healthcare market was valued at USD 264.87 billion in 2020 and is expected to reach USD 662.67 billion by 2027 and is poised to grow at a compound annual growth rate (CAGR) of 14.2% during the forecast period 2021 to 2027.

Let’s look at some of the drivers of this trend and the current landscape.

Technology Advances

Increasing penetration of 5G technology and cloud storage industry growth will scale the ability to collect and aggregate data from remote devices. Wearables and home health monitoring provide a continuous stream of personalized data that can help health care providers improve outcomes by building personalized treatment plans, especially for chronic non-communicable diseases like cancer. While personalized data can lead to better outcomes, medical device manufacturers need to consider the security of the data, too.

Changes for Hospitals and Other On-Site Medical Providers

The COVID-19 pandemic strained healthcare human resources to a breaking point. Nearly 20% of health care workers quit their job as a result of overwhelm and stress. Providers realize the need to develop ways to monitor patients off-site. At the same time, hospitals and other HDOs seeing cost savings of telehealth and at-home monitoring will continue to drive demand for home health monitoring.

Eldercare

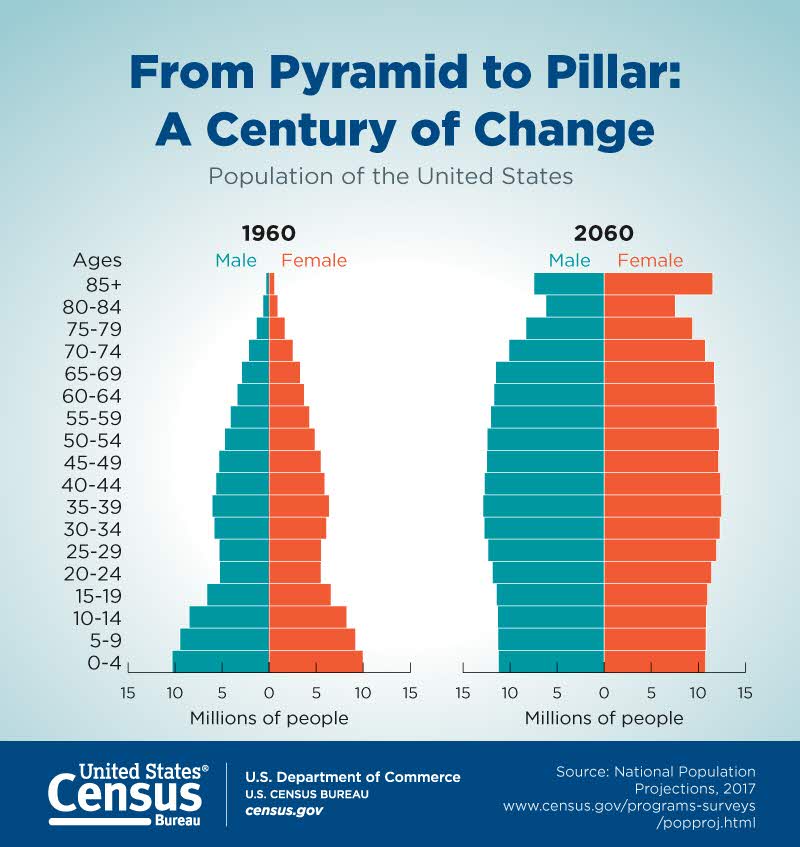

The World Bank estimates that 22% of the world population will be over 60 by 2025, with the majority of older people living in developed countries. According to the US Census Bureau, the share of the elderly population will reach 22% by 2050.

By 2060, nearly one in four Americans will be 65 years and older, and the number of people over 85-plus will triple.

Increase in Lifestyle Diseases in the Aging Population

As people live longer we obviously will see more data about diseases in an aging population.

Unfortunately, that data isn’t simply a reflection of more older people in general.

Lifestyle disease can result from prolonged exposure to unhealthy lifestyle behaviors – smoking, unhealthy diet, and physical activity. Such diseases include obesity, heart disease, chronic obstructive pulmonary disease, stroke, diabetes, metabolic syndrome, and some types of cancer.

In affluent countries with aging populations, advanced healthcare and pharmaceuticals can keep unhealthy people alive for many years. Apart from the emotional toll on the patient and families, lifestyle diseases can represent a considerable expense through loss of independence, years of disability, and ongoing treatment for chronic conditions.

Older adults ages 51 to 61 had a higher prevalence of six out of eight chronic conditions—including 37 percent higher diabetes prevalence—in 2004-2010 than their peers in 1992-1998, according to a 2016 study.

Inactivity, stress, and unhealthy eating habits are the current triple threat to the largest wave of elderly people we have ever seen in the US population.

Market Responses to the Home Healthcare Movement

The home health hub is benefitting from two converging trends. First, consumer companies are developing healthcare-related devices and services. Second, more ‘traditional’ technology and medical device manufacturers are leveraging the internet, cloud, and broadband technologies.

End users fall into two categories that can overlap – patients, who in traditional medicine don’t have a say in choosing the medical device, and general consumers tracking their data for wellness.

Data collected at home for review by a health care professional in the context of managing a health condition is different from an individual who is tracking their vitals for general wellness.

The FDA differentiates between devices and data in this regard, defining a home medical device as follows:

A home-use medical device is a medical device intended for users in any environment outside of a professional healthcare facility. This includes devices intended for use in both professional healthcare facilities and homes.

A user is a patient (care recipient), caregiver, or family member that directly uses the device or provides assistance in using the device.

A qualified healthcare professional is a licensed or non-licensed healthcare professional with proficient skill and experience with the use of the device so that they can aid or train care recipients and caregivers to use and maintain the device.

Consumer Companies Enter the Health Care Market

In 2009 Fitbit released the first fitness tracking bracelet, followed by Apple releasing the first Apple Watch in 2015. Popular consumer wearables like these give individuals an easy way to track their basic fitness metrics. Fast forward to the 2020s. The link between COVID-19 severity and weakened immune systems is causing some consumers to take a more active interest in their health.

Along with Apple, companies with huge non-patient B2C market share, like Samsung, are entering the medical device space.

Alexa, Amazon’s digital assistant, is becoming a digital member of the family in many homes. Amazon is piloting Alexa Together, a subscription service to help families with elderly patient homecare. Best Buy also recently acquired Current Health, an at-home tech care startup.

Medical Devices in the Home

One category where very advanced consumer technology and medical device functionality may overlap is with social robots. Increasing demand for eldercare services will drive the adoption of social robots and even robotic pets. Interaction with social robots can improve the quality of life for some elderly people struggling with isolation or dementia.

Social robots that engage in remote patient monitoring (RPM) may also be able to take patient vitals or be a trusted conduit for gathering more information for off-site health care providers.

Wearable Medical Devices

Wearable medical devices for RPM include glucose monitors and digital blood pressure cuffs that send blood pressure and pulse to their doctors. Wearables are integrated with voice apps that remind patients to take medication or insulin.

Scientists are also developing small sensors to wear as a patch on the skin and track biometrics. Smart clothing can collect biometrics and coordinate patient and health provider apps.

Perhaps the ultimate wearable is the implanted medical device. Knee implants embedded with smart technology can monitor recovery and healing. Doctors can place small sensors in the pulmonary artery to take daily measurements and detect signs of heart failure.

At-home Monitoring

Healthcare recovery and monitoring doesn’t take place in a vacuum. Providers need data from different relevant metrics over time. At-home monitoring kits can be personalized for different use cases and conditions. Some examples include:

- Mayo Clinic gave patients at high risk for COVID-19 remote patient monitoring kit that includes a blood pressure cuff, thermometer, pulse oximeter, and a weight scale, plus a cellular-enabled tablet mobile device that automatically sent the data back to the clinic.

- TytoHome, Remote Health Examination Kit by TytoCare. Includes a digital camera, thermometer, tongue depressor, an otoscope, and a stethoscope.

- ADAMM, Smart Healthcare Monitoring System for Asthma

Home Diagnostic Tests

Patients and consumers increasingly want to pre-diagnose certain conditions without a trip to the doctor. Today, COVID screening tests are a strong growth driver for the test-at-home health market. Quest Diagnostics reports that the market for consumer-driven health testing may be worth more than $2 billion by 2025.

Other at-home testing markets include:

- Food allergies & nutrition

- Disease screening

- Heavy metals testing

- Genetic Testing

- Hormones and hormonal imbalance

Coordination and Integration of Medical Devices

Any market in the growth stage attracts a lot of competition and options. End consumers want medical devices that coordinate technology in a seamless way. For medical device manufacturers, this means that proving efficacy for regulatory approval and creating a compelling offer for health care providers is only part of the package. Companies must pay attention to the end-user patient-as-customer experience as well.

Are there ways your company might benefit from some of these compelling trends in regard to home health monitoring? If you have questions about the merging of traditional medical device markets with the smart home health hub? Contact us today to get the conversation started.