What Investors Want to Know Before Funding an AI-Integrated Medical Device

If you’re seeking funding for an AI-powered medical device, you will be facing a series of targeted questions beyond the usual investment criteria. From intellectual property concerns to data ownership and algorithm maintenance, investors have many questions about how an AI integration affects a medical device’s market potential.

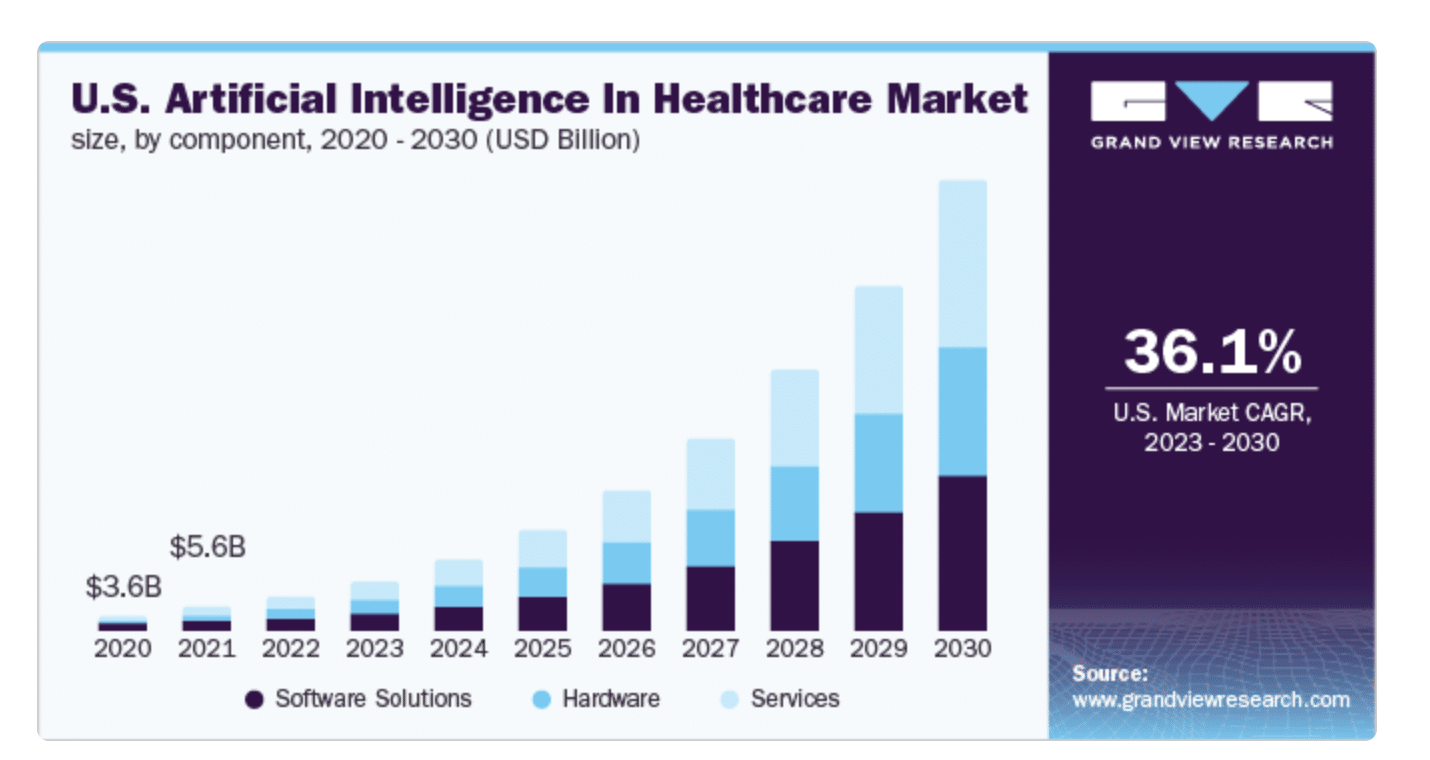

With the projected growth in AI in the healthcare industry, it’s no wonder that AI-integrated devices are capturing investors’ interest more than ever.

While investor interest in AI for medical devices is high, funders are keenly aware that integrating artificial intelligence into healthcare solutions introduces an additional layer of complexity and risk for funding.

This post covers five common questions to help you confidently navigate investor conversations and secure the funding to propel your innovation forward.

Is your device algorithm locked or adaptive?

The kind of AI algorithm integrated into your device impacts the difficulty of securing FDA approval. Investors may ask this to help determine the regulatory approval process will be.

Locked algorithms, which function within set rules and unchanging parameters, offer predictability that simplifies the testing and validation. Adaptive algorithms adjust based on data inputs and user interactions. This variability may present extra hurdles in navigating FDA clearance or approval.

Generally speaking, devices employing locked algorithms have a more streamlined path to FDA approval to those using adaptive algorithms.

Does your AI algorithm involve any IP?

When it comes to investing in AI-integrated medical devices, the question of intellectual property (IP) is often a top concern for investors. This is because IP ownership can impact the valuation and legal risk profile.

An AI algorithm that involves patented or patent-pending technology can significantly increase the valuation of your company. IP ownership is a competitive advantage that can ward off potential competitors and offer a unique selling proposition.

Moreover, IP related to the AI algorithm safeguards against potential legal pitfalls. Investors want to ensure that the technology you’re using hasn’t been borrowed or copied from another entity, which could expose the company to legal challenges down the road. Such disputes drain financial resources and can also result in an injunction against your product, thereby freezing any revenue streams and potentially tarnishing the company’s reputation.

Investors always have an eye on the exit strategy. A clearly defined IP can make future acquisitions more straightforward and potentially more lucrative.

The question about IP is multi-layered and aimed at assessing the company’s market position, risk profile, and long-term viability. Addressing this question well can be a crucial factor in securing investor confidence.

How do you source annotated data in the near term and at scale?

The question of sourcing annotated data is a critical one for investors for several reasons. Quality data is the fuel that powers effective AI algorithms. Without a reliable and scalable source of annotated data, even the most sophisticated algorithms can fail to perform as needed, risking the entire venture.

In the near term, the ability to source quality annotated data indicates that your project can get off the ground successfully. Investors are keenly interested in how quickly you can go from the funding stage to generating actionable insights or delivering actual healthcare outcomes.

A clear plan for sourcing annotated data in the initial stages indicates a well-thought-out business strategy and operational efficiency.

At scale, the issue becomes even more critical. Scalable data sourcing strategies show that the business can grow without being bottlenecked by data limitations. As the user base grows, the algorithm can continue to improve and adapt, prolonging the product’s lifecycle and potentially increasing the return on investment.

Sourcing data at a scale usually involves navigating complex regulatory environments, particularly in health care, where patient data privacy is paramount. A comprehensive strategy for sourcing annotated data must include compliance measures to satisfy regulations like HIPAA in the United States or GDPR in Europe.

Your plans for data acquisition should reveal the team’s business acumen and understanding of the technical and regulatory challenges that greatly influence an investor’s decision to fund a project.

Who owns the data?

Related to data sourcing is the question of ownership. Data ownership in medical devices is important to investors for many reasons, chief among them being legal compliance, value proposition, and long-term sustainability of the business.

In medical devices, especially those integrated with AI, the data can be extremely sensitive and subject to various regulations, such as HIPAA in the United States or GDPR in Europe. Any ambiguity or conflict regarding data ownership could lead to legal challenges that can be costly and damage the company’s reputation.

From a value proposition standpoint, owning the data often means the company has exclusive rights to use it to improve its products, develop new features, or even create new products. This adds a layer of competitive advantage and provides more monetization opportunities, making the investment more attractive.

Data ownership also has implications for the company’s partnership and acquisition potential. Companies that own substantial and valuable data sets are often more attractive for strategic partnerships or acquisitions. Such collaborations can provide additional revenue streams or expedite market penetration, thus potentially increasing the return on investment for the initial stakeholders.

From the investor’s point of view, the issue of data ownership impacts the company’s risk profile, growth potential, and long-term viability.

How often would you need to tune your algorithm, and what are the costs/effort each time?

The question regarding the frequency and cost of tuning your AI algorithm touches on your venture’s technical and operational aspects, making it a crucial point of consideration for investors. Here are some reasons why:

- Technical Efficacy: AI algorithms are not “set it and forget it” tools, especially for medical devices. They require regular tuning to adapt to new data, improve accuracy, and ensure they deliver the most reliable results possible.

- Operational Costs: Regular tuning involves computational resources and skilled personnel who can execute these updates. Investors will be keen to understand how these recurring costs affect the company’s financial health. High operational costs for algorithm tuning could eat into profits and lower the return on investment.

- Scalability: If your algorithm requires frequent tuning that involves significant cost and human intervention, it may limit how quickly the product can scale. Investors are interested in high growth and high returns, so limitations on scalability are a concern.

- Competitive Edge: How often you need to tune your algorithm compared to your competition can determine your product’s success. More efficient algorithms that require less frequent tuning can be a strong selling point.

- Product Lifecycle: Frequent updates might lead to more extended downtime or require customers to update their devices, impacting user experience and satisfaction regularly.

Investors consider algorithm tuning as part of an overall assessment of your venture’s long-term viability and profitability.

Moving Ahead

The FDA regulatory path is complex even without AI considerations, so it’s no surprise that navigating the path to investment for an AI-integrated medical device might feel daunting. As this post shows, the questions investors ask are multifaceted and deeply consequential.

You don’t have to go it alone. At Galen Data we have extensive experience helping medical device companies navigate the regulatory labyrinth. We’re here to help.

Reach out today, and let’s discuss the steps toward turning your innovative vision into a market-ready solution.