SaMD Market 2024 – Overview of Software as a Medical Device Landscape

The healthcare landscape is undergoing a digital revolution, and at the forefront are Software as a Medical Device (SaMD) solutions. These software applications, ranging from diagnostic algorithms to remote monitoring tools, are poised to drive growth in the 2024 SaMD market.

Despite ongoing regulatory hurdles and data privacy concerns, 2023 saw growth in the SaMD sector, fueled by AI integration, cloud adoption, and personalized healthcare trends.

While challenges still persist, SaMDs are still poised to revolutionize healthcare delivery and empower individuals to take charge of their health. Share on XSize and Growth of the SaMD Market 2024

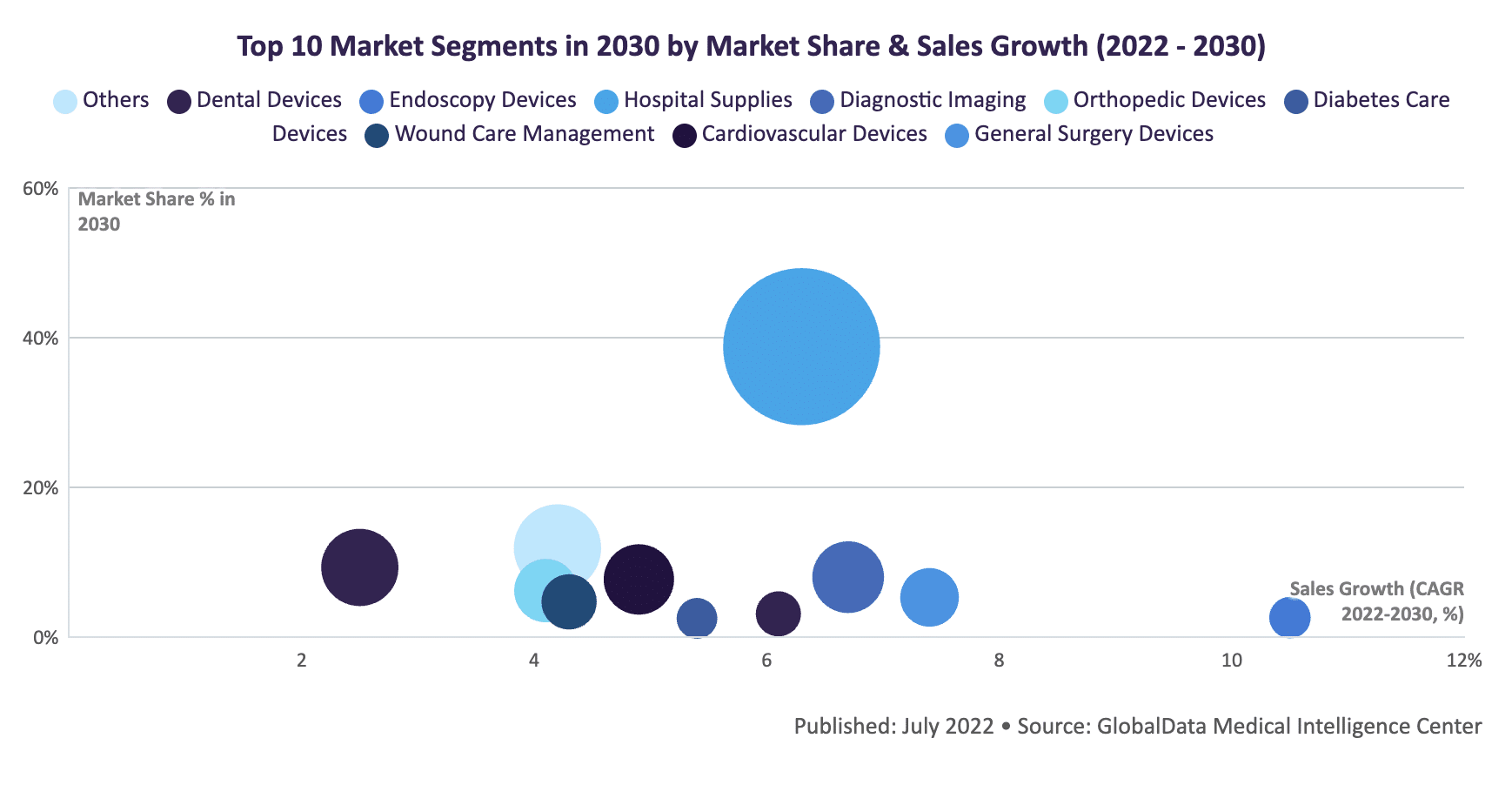

While the graphic below represents the overall medical device market, it illustrates the likely demand for SaMDs in related segments.

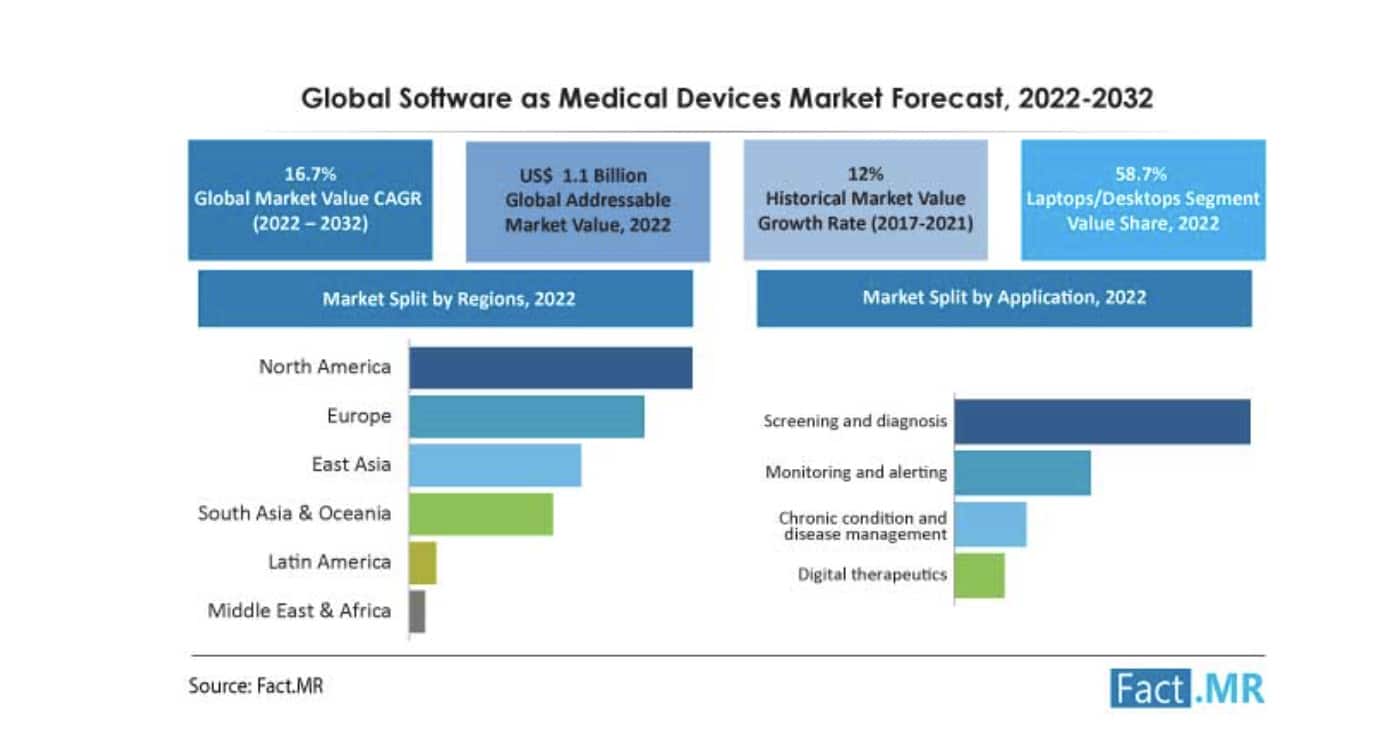

Market report researchers estimated the global 2022 medical device market value for SaMD to be USD 1.2 billion. They forecast it will reach USD 5.4 billion by 2032, growing at a compound annual growth rate (CAGR) of 16.7%.

Research firm Fact.MR breaks out market trends and growth predictions into short, medium, and long-term. In the short term, the SaMD market 2024 – 2025 will see slow approval rates and cybersecurity risks, causing a growth lag in the industry.

In the medium term – 2025 to 2028 – the demand for self-monitoring devices will result in 1.6 X growth.

In the long term, investments and innovations will escalate the global market outlook. Fact.MR estimates an opportunity of US 2.9 billion between 2028 and 2032.

Challenges to SaMD Market Growth

In addition to overall economic uncertainty, several threats exist that could undermine market growth:

- Data privacy concerns: Building user trust and ensuring robust data security measures are crucial for widespread adoption. Apart from overall device safety and efficacy, cybersecurity is the biggest concern of the FDA (and your end users).

- Documentation complexity: Another development hurdle for SaMDs is the need for a Software Bill of Materials (SBOM), a thorough documentation of software components, libraries, and dependencies.

- Integration with existing healthcare systems: Interoperability challenges can hinder the seamless integration of SaMD solutions into clinical workflows.

- Cybersecurity threats: SaMD solutions handling sensitive medical data are vulnerable to cyberattacks, necessitating robust security measures.

- Regulation: SaMD developers face specific regulatory hurdles like standardized guidelines, collaboration between regulators and industry, and adoption of innovative regulatory frameworks. Key regulatory bodies like the FDA and EMA are continuously updating their guidelines to ensure the safety and efficacy of these solutions.

- Classification of SaMD: Categorizing SaMD based on its level of risk can be complex, impacting development and approval processes.

- Data privacy and security: SaMD solutions often handle sensitive medical data, necessitating robust security measures and adherence to data privacy regulations.

- Interoperability: Ensuring seamless integration of SaMD with existing healthcare systems is crucial for widespread adoption.

Regional Breakdown for SaMD Demand

The SaMD market is not a monolith; its growth trajectory and dynamics vary significantly across different regions. Let’s explore a simple market analysis of three key areas: North America, Europe, and Asia-Pacific.

North America

North America stands tall as the current leader via global market size, accounting for over 32% of the share. 15.8 % CGAR by 2032. Several factors fuel this dominance in medical devices:

- Advanced healthcare infrastructure: Well-established healthcare systems with high technology adoption rates create fertile ground for innovative medical device solutions.

- Favorable regulatory environment: While it may not seem streamlined to US SaMD companies, the FDA’s pre-market approval processes are smoother compared to other regions.

- High healthcare spending: High per capita healthcare expenditure allows investment in cutting-edge technologies like SaMD.

Europe

Europe has several unique factors driving demand for SaMD:

- Focus on data privacy and security: Europe emphasizes robust data privacy regulations like GDPR, leading to the development of secure and user-centric medical device solutions. This focus attracts companies to prioritize responsible data handling and building trust with users.

- Aging population: Europe’s rapidly aging population creates a growing demand for remote monitoring and chronic disease management tools.

- Public-private partnerships: Strong collaboration between governments and private players encourages investment and infrastructure development for digital healthcare initiatives, including SaMD adoption.

Asia-Pacific

The Asia-Pacific region boasts a growing population with increasing disposable income, propelling demand for accessible and affordable medical device solutions like SaMD. Other factors affecting the market include:

- Government initiatives: Several regional governments are actively promoting digital healthcare and investing in SaMD infrastructure, creating a supportive environment for market expansion.

- Mobile health boom: The high penetration of mobile technology in Asia-Pacific fosters the development and adoption of mobile-based SaMD solutions and medical devices that make healthcare more accessible and convenient for underserved populations.

While these areas dominate the current landscape, emerging medical device markets like Latin America and Africa also witness demand opportunities driven by specific regional factors. Addressing unmet healthcare needs in these regions with innovative and localized SaMD solutions presents exciting possibilities for future growth.

Innovation and Technological Advancements

Cutting-edge innovations drive growth in the market size, some of the most promising being:

- Rising demand for personalized healthcare: SaMD solutions enable customized treatment plans and preventive measures tailored to individual needs. These apps leverage AI and machine learning to analyze user data and provide personalized health insights, medication reminders, and even preliminary diagnoses.

- Remote monitoring tools: These tools enable real-time patient monitoring, allowing healthcare providers to track vital signs, detect early signs of health deterioration, and intervene proactively.

- Advanced data analytics: SaMD solutions increasingly incorporate sophisticated data analytics capabilities to glean valuable insights from medical data, improving diagnosis, treatment, and research. Several factors fuel this boom:

- Increased AI and machine learning adoption: These technologies empower SaMD applications to analyze medical data, identify patterns, and make informed recommendations.

- Shift towards cloud-based healthcare: Cloud platforms offer scalability, accessibility, and remote data management, fostering the development and deployment of innovative SaMD solutions.

Key Market Players to Watch

SaMD startups and companies are pushing the envelope of innovation in medicine. Here are three key players to watch in 2024:

- Viz.ai (USA): The FDA granted De Novo approval for Viz.ai’s hypertrophic cardiomyopathy (HCM) artificial intelligence (AI) detection algorithm, Viz HCM module. Bristol Myers Squibb provided financial backing for the algorithm’s implementation through a multi-year agreement.

- Rapid AI (USA): RapidAI is building out its offering of artificial-intelligence-powered software tools designed to spot signs of stroke, aneurysm, and other neurological conditions in brain CT scans. The Silicon Valley startup raised $75 million in series C funding in 2023.

- MindMaze (Switzerland): A pioneer in neurotechnology, MindMaze develops SaMD solutions for neurological rehabilitation and cognitive restoration following injuries or diseases. In 2023, they entered a $21 million business combination agreement with Genesis Growth Tech Acquisition.

Venture Funding in SaMD Startups

Although venture funding is down in general, SaMDs are still attracting significant VC investment to the tune of USD 12.2 billion in 2023 alone.

SaMD Market 2024: Moving Ahead

SaMDs are a growing sector in the overall AI and machine learning transformation of society. Finding partners who are comfortable with the unique demands of SaMD development and compliance is a mission-critical part of a successful FDA approval process.

At Galen Data, we have deep experience and our cloud platform provides a cost-effective and compliant solution for medical device connectivity, visualization, analytics, and much more. Reach out today to get the conversation started.