Think Like a VC: How to Succeed With Medical Device Fundraising

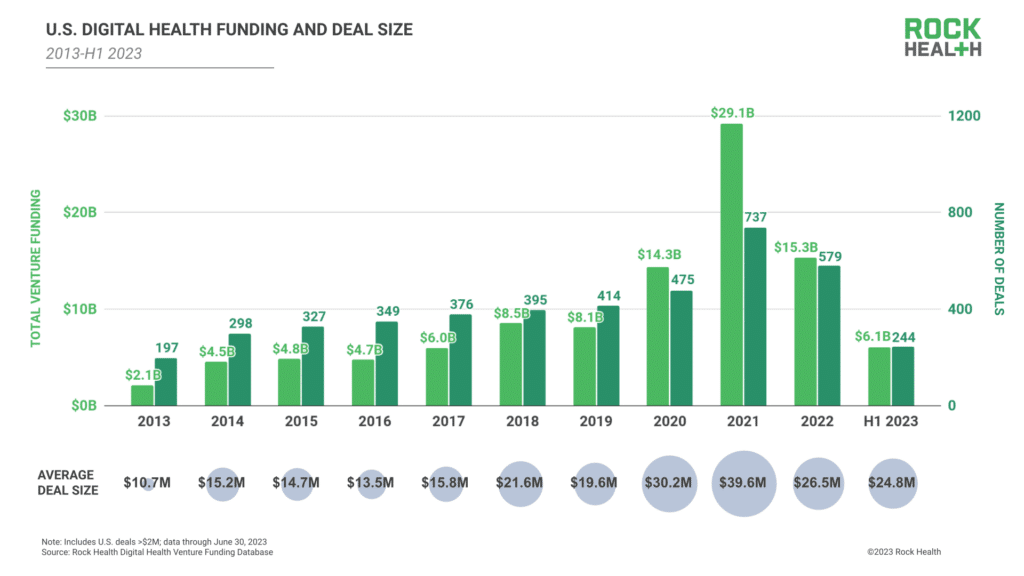

Venture funding ebbs and flows with the tides of overall economic news. Most of us realize that 2023 was not a stellar year for medical device venture capital (VC) funding. According to Medical Device Network, 2023, VC funding for medical devices was down 31% from 2022 and declined 57.4% from its 2021 peak of $49.3 billion.

What this means for the Advanced Medical Device (AMD) industry is that companies seeking funding in 2024 must sharpen their pitch as much as possible.

In any type of negotiation, it’s helpful to put yourself in the shoes of the people across the table. This post will help you look at the pitching process from the VC mindset, as well as cover the basic overview of a solid pitch strategy.

What Is Most Important to VCs in Advanced Medical Device funding?

Because a successful pitch includes many moving parts, it can be easy to get lost in the details or spend too much time in one area. Consider prioritizing your pitch based on what’s most important to VCs. For starters, a startup’s thorough understanding of the market and customer is the most crucial factor for VCs.

Some other important aspects are intangible. One researcher who studied how VCs evaluate pitches found that even though many say they want to see “passion”, in reality, calm confidence backed up with extensive preparation wins the day.

VCs also look for character over competence. The thinking is that if a founder lacks expertise, they can hire someone to fill the void, but there is no substitute for good character.

Finally, being knowledgeable about the tech is essential, but no one likes a know-it-all. Balancing confidence with an openness to being coached can be an advantage.

Understanding VC Priorities and Mindset

Be sure to research individual firms before you request to pitch. Different VCs often specialize in specific niches. Startups must align their business model and product with the VC firm’s criteria by demonstrating a clear understanding of the market, a strong team, and innovative technology.

Below are the essentials that all VCs consider when evaluating investment opportunities:

- Market potential: As mentioned above, a large (and realistic) estimate of potential market size is essential.

- Team: The startup team is a critical factor for VCs. The team should have a potent blend of experience and complementary expertise. Teams that have successfully worked together in the past or for a long time are a plus.

- Product: Of course, the device must be innovative, and it also has to have a solid competitive advantage. For example, a patented medical device that outperforms existing solutions in accuracy, ease of use, and cost-effectiveness could be a competitive advantage. Also, if your device integrates AI, be aware that investors will have specific questions about the details.

- Proof of concept: A proof of concept benefits initial funding rounds. It’s a small project and prototype that tests the functionality and potential implementation of the device.

- Risk: Demonstrate an awareness of potential risks and a plan for mitigating them.

Developing a Compelling Pitch and Business Plan

While your pitch should be polished and tight, it’s not a formal presentation. That’s why preparation and practice are so essential – VCs may ask questions in the middle of the pitch, and you want to be able to go “off script” with more information.

When crafting a MedTech pitch, focus on presenting a unique value proposition that defines the unmet clinical need. What sets your medical device apart from others? Highlight the specific market need your device addresses and how it stands out from competitors. A compelling pitch should also weave in your product’s competitive advantages.

Equally important is a clear business plan. This document should provide a thorough market analysis, clearly defined revenue models, and realistic growth projections. It’s the blueprint that shows VCs how you plan to succeed.

Successful pitches often include quotes from VCs or industry experts endorsing the product or team, which adds credibility and appeal to your proposition.

Evidence of Market Validation and Traction

Demonstrating market validation is critical when seeking venture capital funding. In practical terms, your device needs a “story.” Key elements include:

- Clinical trials that show the effectiveness of your medical device.

- User feedback, especially from early adopters, provides tangible evidence of a market need for your product.

- Metrics from early adoption can offer quantifiable proof of market interest.

- Securing intellectual property, such as patents, can enhance your credibility, showing VCs that your technology is unique and protected.

To showcase traction, consider forming strategic partnerships or launching pilot programs. These initiatives can demonstrate industry confidence in your device.

Navigating Regulatory Pathways and Compliance

No one in the investment will make any money until the device enters the marketplace. For that reason, VCs want to see that you understand the regulatory landscape and have a plan for navigating it.

This includes detailing your approach to meeting compliance standards and how you plan to manage regulatory processes efficiently. A well-defined regulatory strategy assures VCs of a smoother path to market and demonstrates your commitment to safety and efficacy, critical concerns in the medical device industry.

The right partners for scalability and compliance.

Choosing the right partners, particularly for data management during our regulatory journey, is a crucial reassurance for investors. A platform like Galen Data, which provides a cost-effective and compliant solution for medical device connectivity, visualization, analytics, and more, is vital for ensuring your device can handle growth while maintaining data security and meeting regulatory compliance.

By showing a commitment to data integrity and efficient operations, you demonstrate a proactive approach to managing one of the most critical aspects of modern medical device development.

Financial Planning and Exit Strategies

Sound financial planning is vital to the success of any medical device startup. This includes meticulous budgeting, effective burn rate management, and setting clear funding milestones. Keeping a close eye on finances is essential to ensure your startup remains stable and sustainable.

Equally important are exit strategies. Whether it’s acquisition, public offering, or another route, your exit strategy should align with your long-term business goals and meet VC expectations. Thoughtful planning in these areas is essential for both short-term success and long-term viability.

Show Time: Optimizing the Pitch

Having a solid pitch presentation will help you feel confident in answering questions. Here are additional tips:

- Conduct Mock Presentations: Get feedback from colleagues, mentors, or experts.

- Stay Calm and Composed: Respond confidently without getting defensive.

- Practice Active Listening: Listen carefully to understand investor queries fully; don’t jump to answer before they have finished asking.

- Anticipate Common Questions: List potential questions about your business model and healthcare solution.

- Deep Dive into Your Data: Know your data thoroughly for clarifications or detailed insights.

- Prepare Concise Responses: Practice delivering clear, brief answers.

- Understand Regulatory and Compliance Aspects: Be ready to discuss patient data protection and ethical considerations.

- Have Supplementary Materials: Keep extra slides or documents for in-depth explanations.

- Stay Updated: Keep abreast of the latest healthcare trends and research.

- Acknowledge Unknowns: Admit what you don’t know and commit to finding out.

- Reframe Objections as Opportunities: Practice using objections to clarify or highlight potential upsides.

- The bottom line is that VCs are looking for confidence, clarity, and potential in your pitch and plan.

Moving Ahead

All of the above gives a nuanced overview of what to consider with your pitch strategy. This article from Viktori provides an extensive inventory of additional considerations. Many teams also find it helpful to talk with others who have had years of experience in the advanced medical device industry.

If you are working on your fundraising process, you don’t have to go it alone. At Galen Data, we have extensive experience helping medical device companies. Reach out today, and let’s discuss the steps toward turning your innovative vision into a market-ready solution.