The Top 5 Questions Investors Ask Before Investing in a Medical Device Company

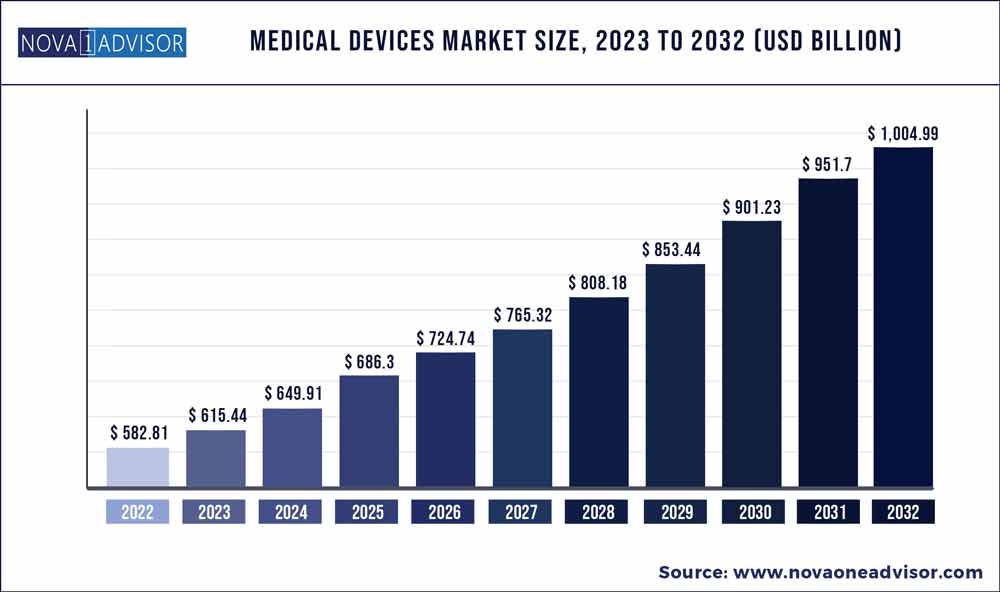

Navigating the advanced medical device development landscape is no small feat, especially when looking to secure investment. Economic uncertainty is causing investors to be more cautious. However, as this chart below from Nova One Advisor shows, overall growth projections in the Medical Device market are unequivocally positive.

Even in a bear market, startups and companies with the right combination of team and technology likely stand a good chance of capturing investor interest. Share on X

Source: NovaOneAdvisor.com

If you are a founder or leader in this high-stakes industry, you’re likely juggling product development, regulatory compliance, and market strategy, among other things. In the churn of priorities, it’s easy to lose sight of what investors want to know before they commit their capital.

To help you understand what matters most, we’ve compiled the top 5 questions investors are most likely to ask before investing in a medical device company. Read on to arm yourself with the insights you need to make your next pitch successful.

Fundraising Basics – The Pitch Deck

The fundraising journey often begins with a well-crafted pitch and business plan. An advanced medical device pitch deck is a presentation that entrepreneurs in the medical device field use to give investors a quick overview of their business plans. Depending on the device concept, the pitch may also include results from a prototype.

When delivered in person or via video presentation, the pitch deck is a visual narrative that complements the spoken presentation.

While the content can vary depending on the specifics of the medical device and the business itself, below are the main sections in an advanced medical device pitch deck:

- Introduction/Executive Summary: A brief overview of the company, the problem it aims to solve, and how the medical device provides a solution.

- Problem Statement: An in-depth look at the issue or need that the medical device addresses, usually backed by data or research.

- Solution: A detailed explanation of the medical device, its unique features, and how it solves the problem stated earlier.

- Market Opportunity: An assessment of the market size, growth potential, and target customers, often supported by statistics and research data.

- Business Model: An outline of how the company plans to make money, including pricing strategies, sales channels, and revenue projections.

- Go-to-Market Strategy: The action plan for introducing the medical device to the market, including market penetration and sales tactics.

- Technology and IP: Information on the technology behind the device, its stage of development, and any intellectual property protections in place.

- Competitive Analysis: A review of competitors in the space, with an emphasis on the unique advantages of the proposed medical device.

- Financial Projections: A forecast of financial performance over the next few years, including income statements, cash flow projections, and balance sheets. Reimbursement from insurance companies or governmental bodies can be a significant factor for market adoption. Outline how your device fits into existing reimbursement models, or how you plan to work towards making it reimbursable.

- Team: Bios of the key team members, focusing on their expertise and how they contribute to the company’s success.

- Ask: The specific request for investment, often stating the amount needed and a breakdown of how the team plans to deploy the investment.

- Appendix/Additional Info: Any other relevant information such as case studies, testimonials, or further data that can support the pitch.

Crafting a compelling advanced medical device pitch deck is crucial for attracting investors and is often a significant first step in the fundraising process for medical device startups. Your pitch deck creates the foundation to elaborate on further questions. Below are five of the most common investor questions.

Question 1: Are you solving a real problem with a viable solution?

Your answer to this question should include a thorough explanation of the medical device’s purpose and its potential impact on healthcare, demonstrating the market need and demand for the device. Provide evidence of how the device addresses a specific problem or gap in the industry.

Question 2: Is your device or technology better, faster, or cheaper?

This question refers to how your device is different from other devices in the marketplace. What sets it apart from the competitors?

The answer should include:

- The device’s unique selling points (USPs) and competitive advantages.

- A comparative analysis of existing products in the market.

- Highlighting any patented or proprietary technologies that give the device an edge.

This question is not only important for the fundraising process but it’s critical for your go-to-market strategy, too.

Question 3: Does your device have strong physician and end-user support?

Evidence of genuine interest from end-users is a powerful factor. Your answer to this question can include clinical trials, pilot studies, or user testing demonstrating the device’s efficacy and acceptance among healthcare providers.

Share testimonials or endorsements from physicians, nurses, or other healthcare professionals who have used the device and can speak to its benefits. Mention any Key Opinion Leaders (KOLs) in the medical field who are involved with or endorse your device. Their support can be a powerful validation of your product’s efficacy and potential market acceptance.

If your device is already on the market, showing feedback from real end users is crucial. In that case, you can discuss metrics like the rate of adoption among healthcare providers and user retention rates, as well as qualitative information gleaned from interviews.

Question 4 – Is there a large enough addressable market?

When investors ask about the size of the addressable market for a medical device, they’re looking for the business’s growth potential. An addressable market large enough to accommodate growth is a key indicator of scalability and potential long-term success.

Begin with a clear and data-supported estimate of the market size. Use credible sources to justify these figures. The Total Addressable Market (TAM) and Serviceable Addressable Market (SAM) can give investors an idea of the business’s growth potential.

Drill down into specific market segments you’re targeting. Is your device aimed at hospitals, outpatient clinics, individual practitioners, or even direct to consumers? This will help investors understand the device’s context in the marketplace.

Discuss any growth trends in the market that could positively impact demand for your device. This could include demographic shifts, emerging healthcare needs, or evolving treatment methodologies.

Question 5: What is the regulatory and clinical validation status?

Besides building a safe, effective device, FDA approval is the major milestone in advanced medical device development. Potential investors want a clear overview of the device’s regulatory pathway and any approvals or snags. They want to see a concise summary of clinical trial results and evidence of the device’s safety and efficacy.

Finally, showing awareness and a plan for addressing any potential regulatory hurdles or risks shows that your team is responsive and strategic.

The FDA is constantly trying to keep up with innovation, for example, with AI in advanced medical devices. The upside is that changes in regulations can open up new markets or make existing markets more accessible. Mention if any such tailwinds benefit your device.

Moving Ahead

Successful pitches result from having a compelling device concept, a solid business plan, and good answers to investors’ questions. Projecting confidence is an advantage and most teams practice their “pitch” until delivering it becomes like second nature.

While we can’t help you with your fundraising stage presence, we can certainly help you prepare for the show! Are you preparing your project for a fundraising effort? At Galen Data, we are tracking emerging trends like AI and its impact on funding, as well as Software as a Medical Device (SaMD). We are knowledgeable about all stages of medical device development. It’s never too early to start the conversation about how your FDA compliance fits into your plans. Reach out for a conversation today.